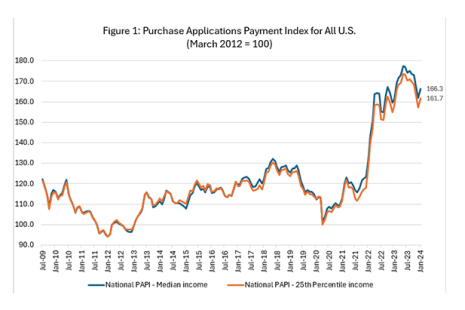

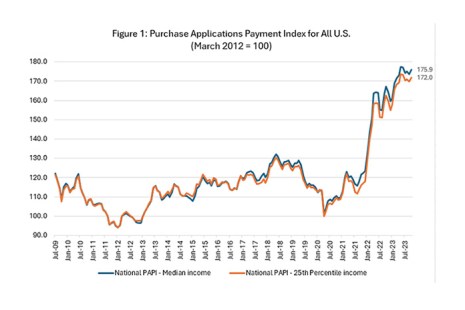

Homebuyer affordability declined in January, with the national median payment applied for by purchase applicants increasing to $2,134 from $2,055 in December. This is according to the MBA Purchase Applications Payment Index, which measures how new monthly mortgage payments vary across time – relative to income – using data from MBA’s Weekly Applications Survey.

Tag: Edward Seiler

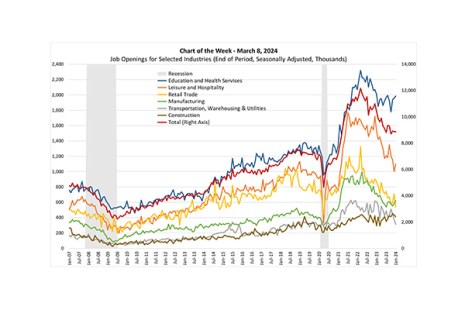

MBA Chart of the Week: Job Openings for Selected Industries

Last week Fed Chair Jay Powell testified to Congress that as “labor market tightness has eased and progress on inflation has continued, the risks to achieving our employment and inflation goals have been moving into better balance.”

MBA: Mortgage Application Payments Increased 3.8% to $2,134 in January

Homebuyer affordability declined in January, with the national median payment applied for by purchase applicants increasing to $2,134 from $2,055 in December. This is according to the MBA Purchase Applications Payment Index, which measures how new monthly mortgage payments vary across time – relative to income – using data from MBA’s Weekly Applications Survey.

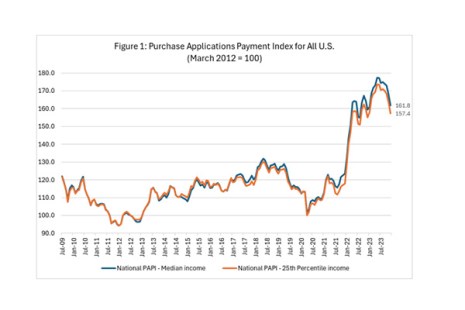

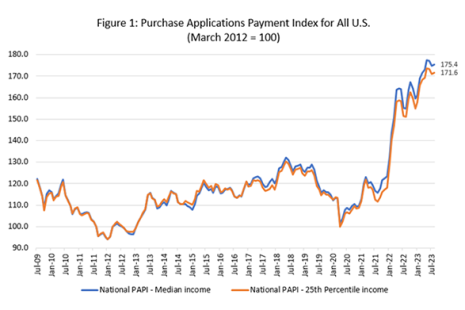

MBA: Mortgage Application Payments Decreased 3.8% to $2,055 in December

Homebuyer affordability improved in December, with the national median payment applied for by purchase applicants decreasing to $2,055 from $2,137 in November.

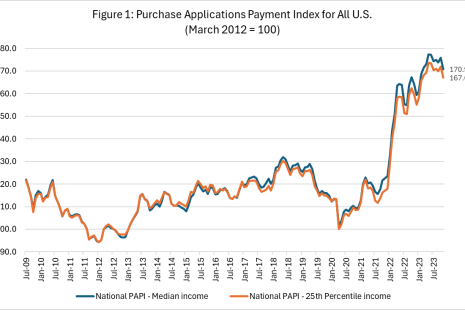

MBA: Mortgage Application Payments Decrease 2.8% to $2,137 in November

Homebuyer affordability improved in November, with the national median payment applied for by purchase applicants decreasing to $2,137, according to the Mortgage Bankers Association’s Purchase Applications Payment Index.

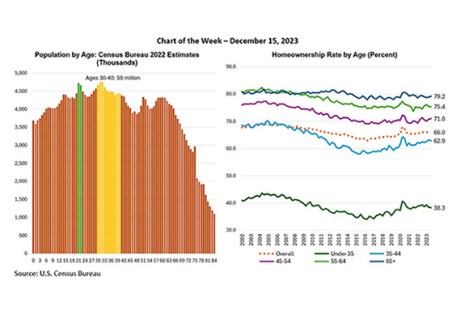

MBA Chart of the Week: Demographics of Potential First-Time Homebuyers

One of the main drivers for optimism is the country’s demographics. In this week’s MBA Chart of the Week, we highlight this by looking at the large cohorts of potential first-time homebuyers.

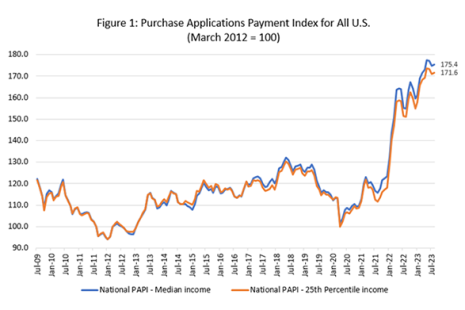

MBA: Mortgage Application Payments Increased 2% to $2,199 in October

Homebuyer affordability declined in October, with the national median payment applied for by purchase applicants increasing to $2,199 from $2,155 in September, the Mortgage Bankers Association reported.

MBA: Mortgage Application Payments Increased Slightly to $2,170 in August

Homebuyer affordability declined in August with the national median payment applied for by purchase applicants increasing to $2,170 from 2,162 in July according to the Mortgage Bankers Association’s Purchase Applications Payment Index.

MBA: Mortgage Application Payments Increased Slightly to $2,170 in August

Homebuyer affordability declined in August with the national median payment applied for by purchase applicants increasing to $2,170 from 2,162 in July according to the Mortgage Bankers Association’s Purchase Applications Payment Index.

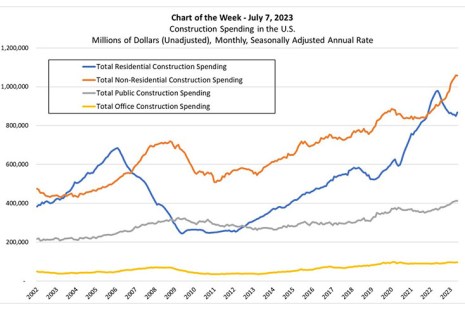

MBA Chart of the Week July 10, 2023

The U.S. Census Bureau released updated construction spending survey data. Also referred to as the Value of Construction Put in Place, the survey covers all private residential construction and improvements, non-residential construction, and public construction.