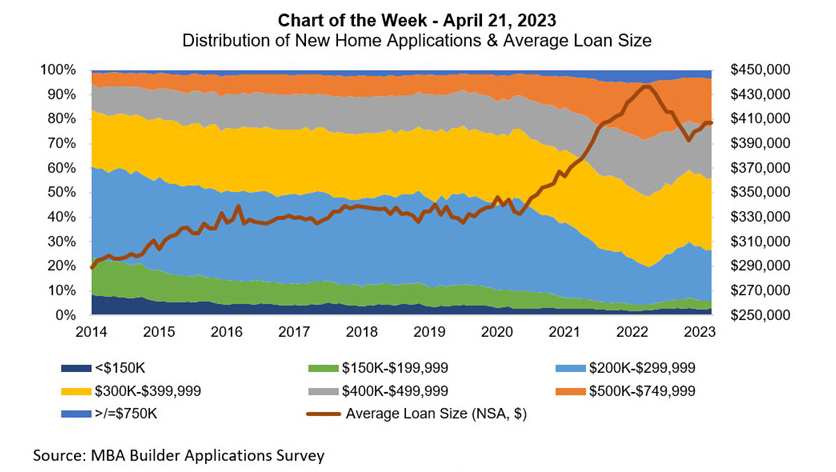

MBA Chart of the Week Apr. 21, 2023–New Home Applications, Average Loan Size

According to data from MBA’s Builder Applications Survey, applications taken by home builder affiliate mortgage lenders in March for the purchase of new homes increased 10 percent month-over-month and were up slightly from a year ago. Low for-sale inventory continues to constrain home sales, along with mortgage rates that remain above 6 percent. However, new home sales will be key to the housing market recovery in 2023 as they account for an increasing share of the purchase market, while much of the inventory for existing homes is locked-in with lower mortgage rates.

This week’s MBA Chart of the Week delves into builder applications by loan size, to illustrate how the mix of the new home market has changed since 2014. Applications for smaller purchase mortgages—those below $300,000— accounted for approximately 60% of new home purchase applications in 2014 and were drifting lower until this trend accelerated in 2020. The pre-2020 trend was indicative of the lack of starter home construction, and this was exacerbated by a surge in demand in 2020 through early 2022, when mortgage rates dropped to historical lows and as home price growth spiked driven by demand outstripping supply, sharply reducing affordability. The share for these smaller purchase mortgages fell below 20% in April 2022—the month the average loan size reached a record $437,000.

Conversely, higher loan size categories saw gains in share, particularly in the $400,000 to $499,999 (11% in 2014 to 22% in 2022) and the $500,000 to 749,999 (6% in 2014 to 21% in 2022) categories.

The steep increase in mortgage rates in 2022 from 3% to more than 7% put a damper on overall purchase activity, but as rates have backed off 2022 highs and continue to oscillate around 6.4%, we have seen this mix of new home sales applications change. The share of applications in the $200,000-299,999 category has grown from 15% to 20%, and the share of applications in the $300,000-$399,999 category has held steady at around 29%. Both the highest and lowest loan size categories have shrunk slightly. Price declines in the most expensive markets in the country, coupled with a weakening economy, have contributed to less activity in the highest segment, while affordability constraints continue to weigh on the lowest segments. Those buyers who have been willing and able to purchase at current rates seem to be driving the activity in the middle of the spectrum.

–Joel Kan jkan@mba.org; Edward Seiler eseiler@mba.org.