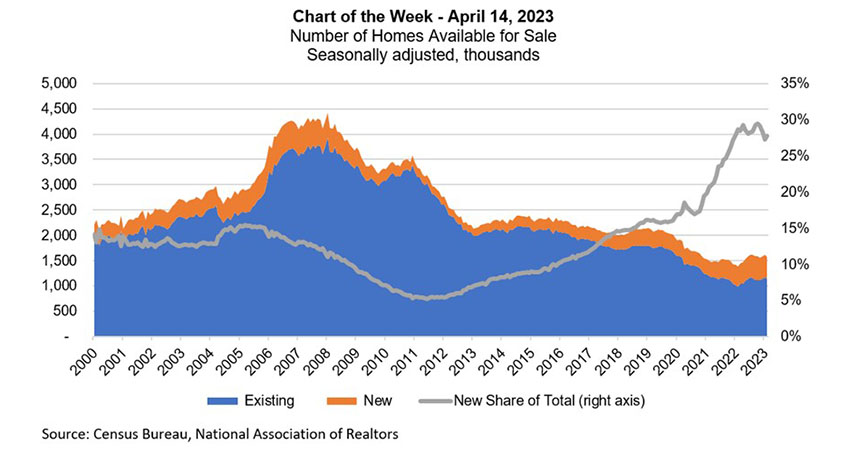

MBA Chart of the Week, Apr. 14, 2023: Number of Homes Available for Sale

MBA’s forecast calls for a gradual recovery in home purchase activity in the second half of 2023, driven by some catch-up buying from 2022 when mortgage rates surged and by younger age cohorts entering homeownership. However, this recovery will be dependent on affordability conditions improving – home price growth moderating, mortgage rates declining, as well as a sufficient supply of for-sale units to meet demand.

This week’s MBA Chart of the Week focuses on the number of housing units for sale. As of February, the number of existing homes available for sale was 1.137 million units compared to 936,000 units a year ago. The average for 2000-2019 was just under 2.5 million units. There were 436,000 new homes available for sale in February, up from 396,000 units a year ago. The average from 2000 to 2019 was 310,000 units. As noted in the chart, the supply of both existing and new homes was tracking below historical trends in the decade before 2020, as home building slowed drastically following the 2008-2010 Great Recession. The surge in demand in 2020 and 2021, along with the disruption to home building activity, further exacerbated the shortage in for-sale inventory.

The impact of low inventory and outsized demand contributed to the recent rapid home price growth, which saw a peak of around 19 percent national annual growth in late 2021. That drove the median monthly mortgage payment higher as loan sizes increased, and this was pushed even higher when mortgage rates more than doubled in 2022. The national median mortgage payment was $2,061 in February, up $408 from one year ago, equal to a 24.7 percent increase.

The existing home inventory is likely to remain depressed for the foreseeable future, as many of these homeowners have mortgage rates below 4 percent. With current rates around 6 percent, these homeowners will be reluctant to sell their homes to purchase another with a significantly higher rate. The inventory for new homes however, has grown in recent months as home builders have worked through much of their pandemic-era backlogs and the rate of completions has picked up. New homes now account for 28 percent of the for-sale inventory, compared to an average of 11 percent from 2000 to 2019, and provide options for home buyers who still face competition in bidding for existing homes.

Another aspect that is still unclear is the availability of less expensive starter homes, which continues to be in short supply, but are much needed given that a significant portion of housing demand is expected to come from first-time homebuyers who are more sensitive to the lack of affordability in the current market.

–Edward Seiler eseier@mba.org; Joel Kan jkan@mba.org.