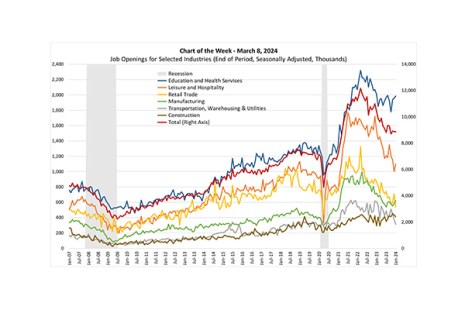

Last week Fed Chair Jay Powell testified to Congress that as “labor market tightness has eased and progress on inflation has continued, the risks to achieving our employment and inflation goals have been moving into better balance.”

Tag: MBA Chart of the Week

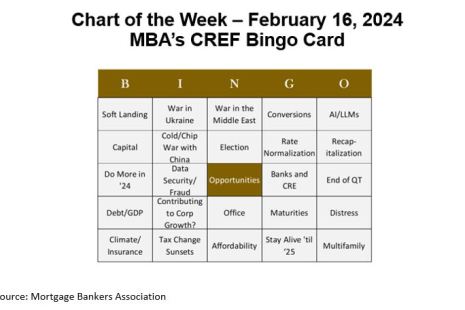

Chart of the Week: MBA’s CREF Bingo Card

Many of us just returned from MBA’s Commercial Real Estate/Multifamily Finance Convention and Expo. That means we showcased our annual CREF BINGO card, highlighting the topics expected to be discussed in sessions, meetings, hallways and over drinks.

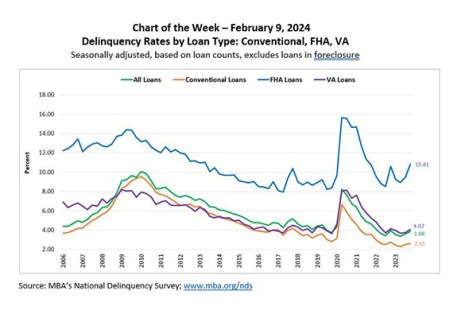

MBA Chart of the Week: Delinquency Rates by Loan Type

According to the latest MBA National Delinquency Survey, the overall delinquency rate for mortgage loans on one‐to‐four‐unit residential properties increased to a seasonally adjusted rate of 3.88 percent of all loans outstanding at the end of the fourth quarter.

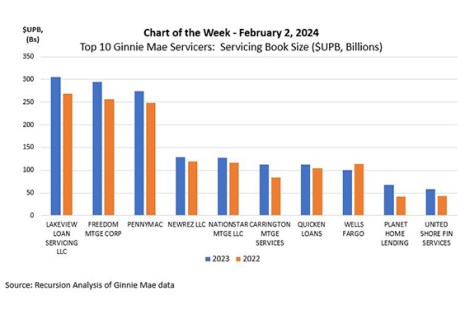

MBA Chart of the Week: Top 10 Ginnie Mae Servicers

This week’s MBA Chart of the Week highlights analysis by Recursion, a big data mortgage analytics firm, that ranks the 10 largest Ginnie servicers by servicing book size ($UPB).

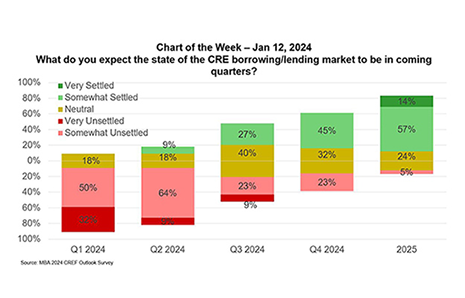

MBA Chart of the Week: Expectations for the CRE Borrowing/Lending Market

Even though many commercial real estate loans are long-lived, there’s a sense that the industry starts each year fresh. Sometimes, that means losing credit for all the deals and successes of the previous twelve months. Sometimes – like now – it means being able to put last year in the rearview mirror.

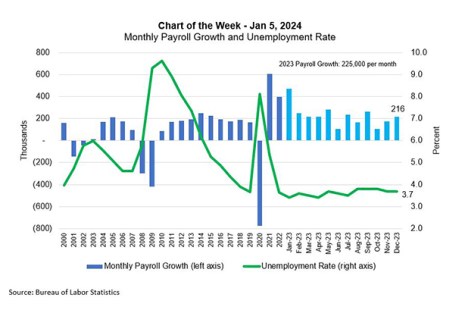

MBA Chart of the Week: Monthly Payroll Growth and Unemployment Rate

Friday’s report from the Bureau of Labor Statistics showed that the job market remained relatively strong in December, with growth in payrolls of 216,000 – just below the monthly average of 225,000 for full-year 2023.

MBA Chart of the Week: 30-Year Fixed Rate

As we summarize the state of the mortgage market in 2023, there is one series in particular that encapsulates the situation, mortgage interest rates.

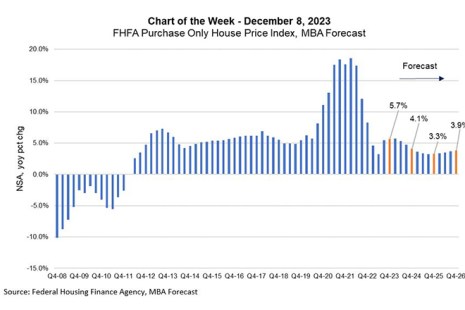

MBA Chart of the Week: FHFA Purchase Only House Price Index; MBA Forecast

This week’s Chart of the Week shows the historical national home price growth and MBA’s forecast through 2026.

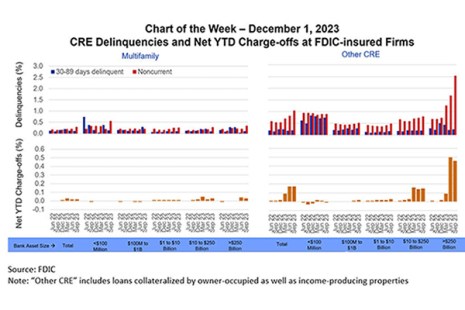

MBA Chart of the Week: CRE Delinquencies and Net YTD Charge-offs at FDIC-Insured Firms

Since March 2023, a recurring set of questions has revolved around a) how conditions in commercial real estate are affecting banks and b) how conditions with banks are affecting CRE.

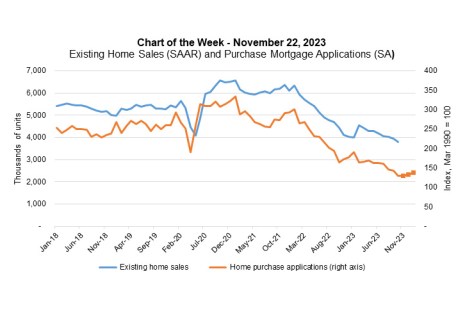

MBA Chart of the Week: Existing Home Sales (SAAR) and Purchase Mortgage Applications (SA)

This week’s MBA Chart of the Week highlights the paths of existing home sales and purchase applications over the past five years.