MBA Chart of the Week: Actual and Modeled CRE Lending ($Billions)

MBA’s latest commercial real estate finance (CREF) forecast anticipates 2023 origination volumes ($442 billion) will come in just a bit more than half of what they were in 2022 ($816 billion).

Perhaps more significantly, it anticipates a slower bounce-back in activity than previous forecasts, driven by “higher-for-longer” interest rates resulting not just from the Federal Reserve’s signals that it will maintain the Fed Funds rate at economic-dampening levels, but also because of questions about the impacts of quantitative tightening, persistent federal deficits, and a host of other influences.

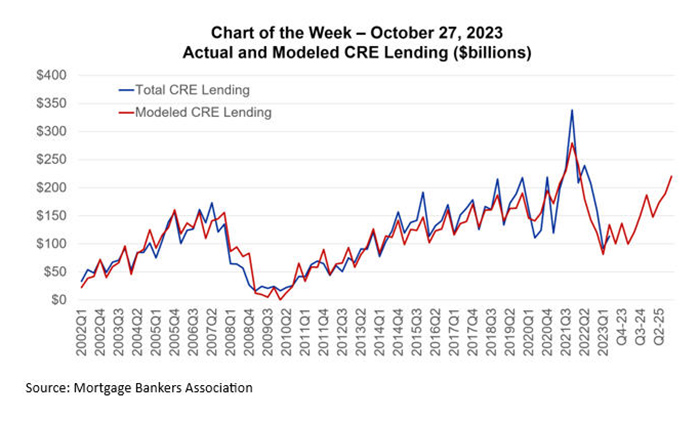

MBA’s CREF forecast is built on our macro-economic outlook and models how, in the past, factors like Treasury yields, the unemployment rate, inflation, home price growth, and mortgage rates have signaled changes in CRE property incomes, cap rates spreads, property values, and originations volumes.

This week’s Chart of the Week highlights what happens when we push our baseline macro-economic forecast through models of past relationships to CRE activity, and then compares the results to actual originations. In our base case economic outlook, originations in 2024 would be 32 percent lower than in 2022 — largely because cap rates would be 136 basis points higher and values 15 percent lower than their 2022 averages. Originations in 2024 would be 26 percent higher than their anticipated 2023 volumes.

There are myriad paths for the economy, interest rates and CRE mortgage volumes and we echo Fed Chair Jerome Powell’s recent comments that forecasters are a humble lot with a great deal to be humble about. We have also heard from members, regulators, and others that they value our outlook and the thinking behind it to help them further hone their own. Based on past experience, our CRE forecast suggests that higher-for-longer rates are likely to delay and suppress the bounce-back in CRE activity — and also that 2023 is expected to be the trough.

-Jamie Woodwell (JWoodwell@mba.org)