MBA Chart of the Week: Annual Origination Counts

Source: MBA Forecast

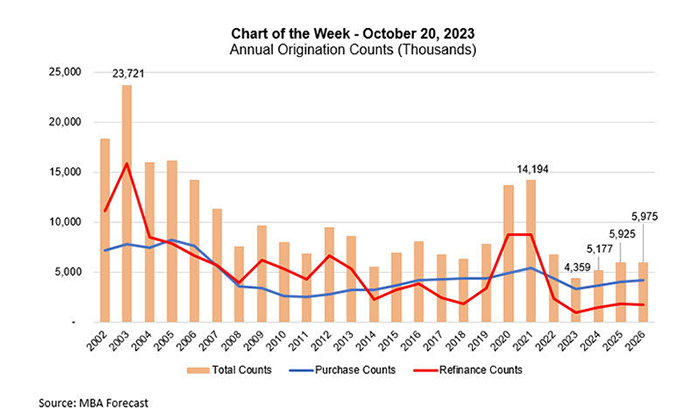

Last week at the MBA Annual Convention and Expo in Philadelphia, our Research & Economics team presented the October forecast, which showed that total mortgage origination volume is expected to increase to $1.95 trillion in 2024 from the $1.64 trillion expected in 2023.

By loan count, total mortgage origination units are also forecast to increase by 19 percent, to 5.2 million loans in 2024 from 4.4 million loans expected in 2023. The estimated total for 2023 marks the lowest year dating back to at least 2002. Due to the low level of loans and sharp drop from 2020 and 2021 levels, net production losses for many lenders have persisted in 2023 and will likely continue through next spring. Even with an increase in loan counts in 2024, there will be fewer originated loans than in 2014 and 2018, both of which were challenging years for the industry.

Excess capacity continues to be a challenge for mortgage lenders, resulting in low productivity levels and high expenses per loan. Lenders have reduced their headcounts and gross expenses, with per-loan costs declining in the second quarter of 2023 after almost three years of increases, based on data from the MBA’s Quarterly Performance Report (QPR). However, the record-low volume has been a primary driver of these escalating per-loan costs over the past couple of years.

Based on MBA analysis of employment data from the BLS, CSBS, and QPR, the magnitude of the peak to trough drop in origination volume is estimated to result in a 30 percent decrease in mortgage employment for capacity to “right size”. We are about two-thirds of the way there, based on the most recent data.

As the economy slows and inflation moves lower, longer-term rates will decline from current levels, helping to bring mortgage rates lower. The forecast is for mortgage rates to end 2024 at 6.1 percent and reach 5.5 percent at the end of 2025. Demographic fundamentals still support housing demand and lower rates will improve housing affordability and unlock some housing inventory as owners become more willing to give up their current rates and list their homes. These factors combined should support purchase market growth in 2024 and 2025, giving the industry a much-needed boost.

Joel Kan (jkan@mba.org), Marina Walsh, CMB (mwalsh@mba.org)