MBA Chart of the Week: Existing Home Sales (SAAR) and Purchase Mortgage Applications (SA)

(Source: National Association of Realtors, Mortgage Bankers Association; Image courtesy of MBA)

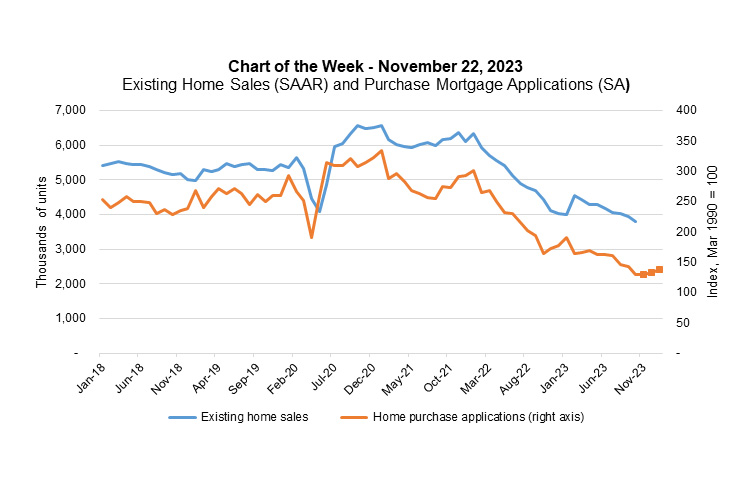

This week’s Chart of the Week highlights the paths of existing home sales and purchase applications over the past five years. The October average for the MBA’s purchase applications index was the weakest month since January 1995. However, since the last week of October, purchase applications have ticked up for three consecutive weeks, indicated by the portion of the orange line with the square markers, as mortgage rates edged lower from multiyear highs. According to this week’s report from the National Association of Realtors, existing home sales in October declined 4.1% to an annualized sales pace of 3.79 million units, the lowest level since 2010.

Purchase applications are often seen as a leading indicator of home sales, and if this recent recovery persists, it is likely that existing home sales too might turn a corner. However, we are still at very low levels of both existing home sales and purchase application activity compared to historical standards, with applications still running at a pace that is 20% below the same time last year. Low levels of for-sale inventory for existing homes and affordability challenges continue to put a damper on homebuying activity. However, a portion of buyers have shifted their preference to newly constructed homes.

Mortgage rates have been one contributor to the erosion in affordability. The 30-year fixed rate stood at 7.41% last week, almost two percentage points higher than the 5.55% average for 2022 and more than double the average rates in 2020 and 2021. However, rates down 20 basis points over the week and almost 50 basis points lower than a month ago may have supported this small rebound in purchase activity.

We forecast that mortgage rates will continue to move down gradually in 2024, which will support moderate growth in home sales and purchase originations, in addition to demographic factors such as a growing share of the population approaching prime home buying ages. Lower rates will also help to free up additional existing inventory as the lock-in effect fades.

–Joel Kan (jkan@mba.org)