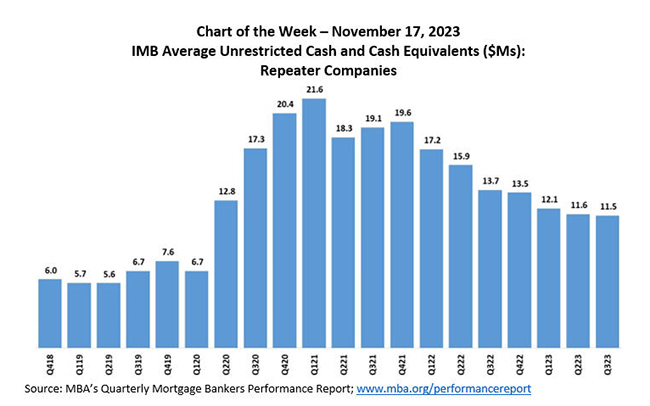

MBA Chart of the Week: IMB Average Unrestricted Cash & Cash Equivalents

Source: MBA’s Quarterly Mortgage Bankers Performance Report; www.mba.org/performancereport

MBA Research recently released the third quarter results of its Quarterly Mortgage Bankers Performance Report. The results showed that independent mortgage banks and bank subsidiaries reported a pre-tax net loss of $1,015 on each loan they originated in the third quarter of 2023, an increase from the reported loss of $534 per loan in the second quarter of 2023. This was the sixth consecutive quarter of production losses, and MBA forecasts lower industry volume over the next two quarters compared to last quarter, which means a turnaround is unlikely until the second quarter of 2024.

Despite these net production losses, the cash position among independent mortgage companies is still strong through the third quarter of 2023, although declining. Today’s Chart of the Week shows the average unrestricted cash and cash equivalents for repeater companies – those companies that submitted data each quarter from the fourth quarter of 2018 through the third quarter of 2023. Unrestricted cash, a measurement of liquidity, is cash that is readily available to be spent for any purpose and has not been pledged as collateral for a debt obligation or other purpose.

At its peak in the first quarter of 2021, unrestricted cash per repeater company averaged $21.6 million, compared to the latest quarter’s $11.5 million, almost a 50 percent decline. Yet the unrestricted cash available in the third quarter of this year was substantially higher than pre-pandemic levels that ranged between $5.6 million and $7.6 million. The accumulated liquidity achieved during 2020 and 2021 when production margins reached record levels and ongoing cash flows from mortgage servicing have allowed some mortgage companies to operate at net production losses over an extended period of time.

– Marina Walsh, CMB (mwalsh@mba.org); Jenny Masoud (jmasoud@mba.org)