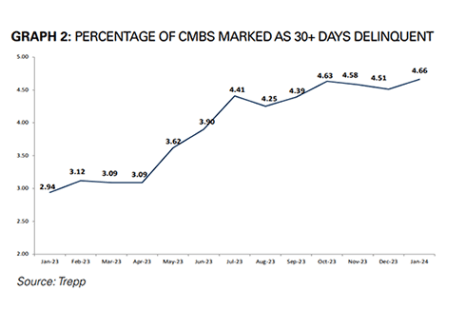

The CMBS delinquency rate rose modestly in January, increasing 15 basis points to 4.66%, according to Trepp, New York.

Tag: CMBS

Trepp: CMBS Delinquency Rate Falls in December

Trepp, New York, noted the overall commercial mortgage-backed securities delinquency rate fell by seven basis points to 4.51% in December.

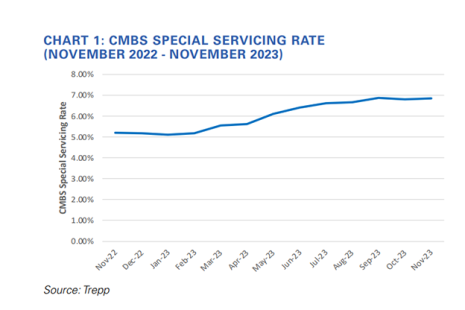

CMBS Special Servicing Rate Ticks Upward in November: Trepp

Trepp, New York, reported the commercial mortgage-backed securities special servicing rate increased 4 basis points in November to 6.84%.

KBRA CMBS Outlook: Cloudy, With a Glimmer of Hope

Kroll Bond Rating Agency, New York, just released its CMBS 2024 Sector Outlook, which forecasts U.S. issuance activity for the new year and highlights key credit trends from 2023. MBA NewsLink interviewed KBRA’s Larry Kay and Andrew Foster to get their views on the current lending environment and property fundamentals as well as factors that may affect overall property performance in 2024.

KBRA: CMBS Delinquency Rate Ticks Upward

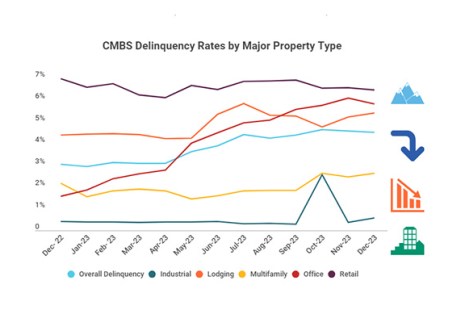

KBRA, New York, said the delinquency rate among KBRA-rated U.S. commercial mortgage-backed securities increased 19 basis points in November to 4.4%.

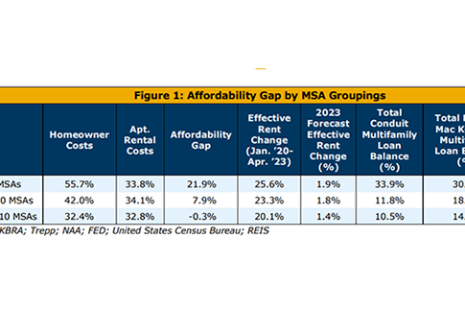

KBRA: Securitized Multifamily and the Housing Affordability Gap

Since 2020, greater apartment rent increases occurred in markets with higher homeownership costs as lower affordability drove up demand for rental units, reported KBRA, New York.

KBRA: Securitized Multifamily and the Housing Affordability Gap

Since 2020, greater apartment rent increases occurred in markets with higher homeownership costs as lower affordability drove up demand for rental units, reported KBRA, New York.

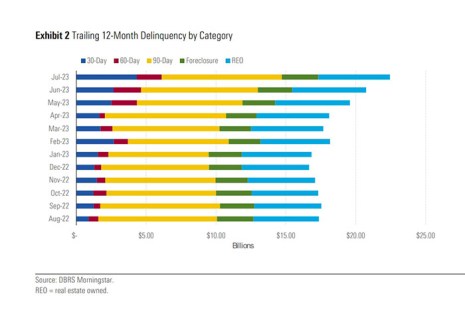

DBRS Morningstar: CMBS Delinquency Rate Surges

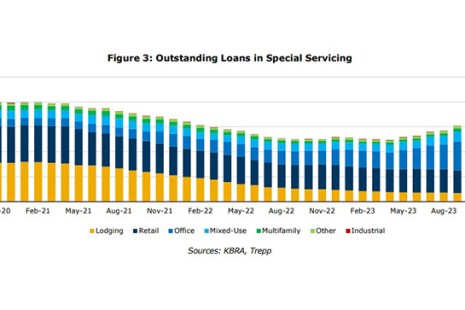

DBRS Morningstar, Toronto, reported the delinquency rate for loans packaged in commercial mortgage-backed securities surged 31 basis points in July. The special servicing rate rose for the fifth straight month, increasing 24 basis points during July.

Fitch Ratings: NOI Growth for CMBS Properties Sees Good 2022, but Slower 2023 Likely

Fitch Ratings, New York, reported property-level net operating income for loans securitized within Fitch-rated U.S. multi-borrower CMBS grew 6.3% in 2022, but warned that kind of growth likely won’t be sustainable this year.

Commercial Real Estate Reset? A Special Servicing Roundtable

As property sale transactions and originations stall, MBA NewsLink interviewed two special servicing executives and a CMBS researcher to get their insights on the commercial real estate finance landscape and outlook.