KBRA: CMBS Delinquency Rate Ticks Upward

(Illustration courtesy of KBRA)

KBRA, New York, said the delinquency rate among KBRA-rated U.S. commercial mortgage-backed securities increased 19 basis points in November to 4.4%.

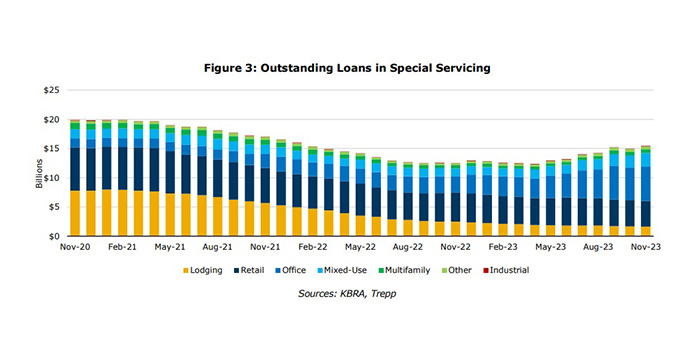

The total delinquent and specially serviced loan rate, or distress rate, experienced a larger 35 basis point increase to 6.88%, KBRA’s CMBS Loan Performance Report said. “On a positive note, the retail and lodging sector distress rates declined month-over-month for the sixth and fourth consecutive month, respectively,” the report said.

KBRA reported CMBS loans totaling $2.1 billion were added to the distress rate in November. “Of note, a majority of the office special servicing transfers this month were not driven by imminent or actual maturity default, as was the case in prior months, but by term defaults–including those where borrowers sought relief well in advance of maturity,” the report said. “Of the 26 newly distressed office loans this month, 15 (more than 57% by count) have maturity dates that are over a year away.”

Other key observations of the November 2023 performance data include:

October’s respite in the office sector distress rate–which declined after trending upward for six straight months–abruptly ended in November. The distress rate meaningfully increased 116 basis points.

The distress rate for the retail sector decreased for the sixth straight month, while the lodging sector saw its fourth straight month-over-month drop.

The report examines $315.4 billion in U.S. private label CMBS including conduits, single-asset single borrower and large loan transactions.