Trepp: CMBS Delinquency Rate Falls in December

(Image courtesy of Trepp; breakout image courtesy of Francis Desjardis/pexels.com)

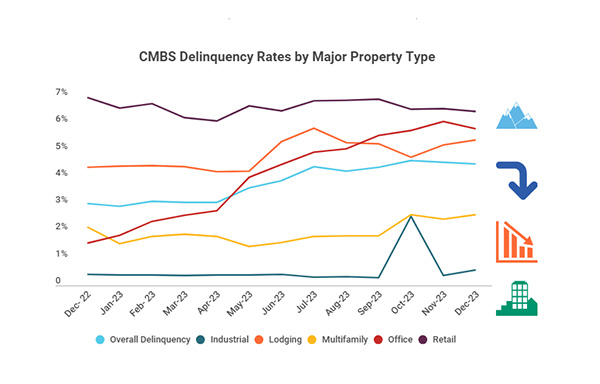

Trepp, New York, noted the overall commercial mortgage-backed securities delinquency rate fell by seven basis points to 4.51% in December.

However, year-over-year, the delinquency rate is up 147 basis points.

Loans that are beyond their maturity date but current on interest show a delinquency rate of 5.49%, a nine-basis-point drop from November.

The percentage of loans in the 30-days delinquent category is 0.23%, down nine basis points.

The percentage of loans that are seriously delinquent (more than 60 days delinquent, in foreclosure, REO or non-performing balloons) is at 4.28%, up two basis points from November.

The CMBS 2.0+ delinquency rate fell seven basis points, to 4.31% from November to December, but is up 150 basis points year-over-year.

The percentage of CMBS 2.0+ loans that are seriously delinquent is 4.08%, up three basis points.

In the office sector overall, the delinquency rate dropped 26 basis points to 5.82%–marking the first drop in a few months.

In the industrial sector, the delinquency rate increased by 19 basis points to 0.57%; lodging also rose by 19 basis points, to 5.4%.

The multifamily delinquency rate rose 16 basis points to 2.62%.

The retail delinquency rate fell, by 10 basis points to 6.47%.