Fitch Ratings, New York, said the commercial mortgage-backed delinquency rate fell six basis points in October to 1.89%, but forecast it could increase significantly in 2023.

Tag: CMBS

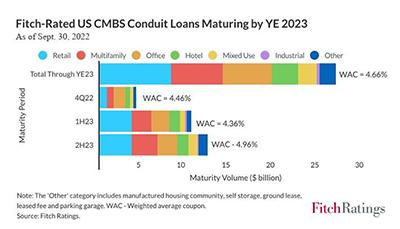

Fitch: Most Maturing CMBS Conduit Loans Can Refinance

Maturing commercial mortgage-backed securities loans have elevated refinancing risk due to rising interest rates and a weakening macroeconomic outlook, reported Fitch Ratings, New York.

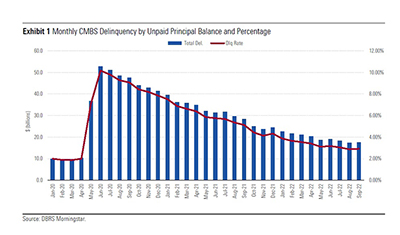

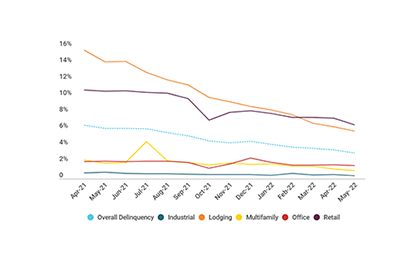

CMBS Delinquency Rate Rises

DBRS Morningstar, New York, said the delinquency rate for loans packaged in commercial mortgage-backed securities rose in September for just the third time since mid-2020.

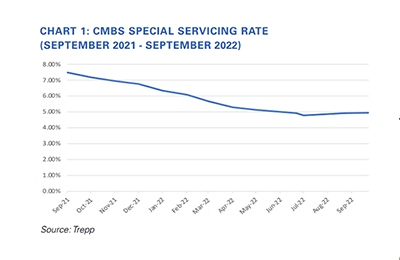

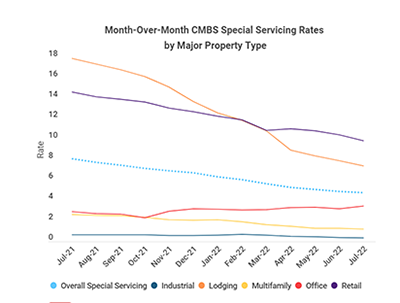

CMBS Delinquency Rate Falls; Special Servicing Rate Increases

The commercial mortgage-backed securities delinquency rate fell slightly in September, offset by an increase in the special servicing rate.

CMBS Supply-Demand Fundamentals Improve Slightly

Moody’s Investors Service, New York, said the supply and demand outlook for most property types in the securitized commercial real estate market improved slightly in the second quarter.

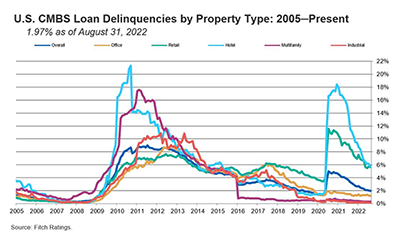

CMBS Loan Delinquency Rate Drops Below 2%

Fitch Ratings, New York, said the commercial mortgage-backed securities delinquency rate fell eight basis points in August to 1.97% due to continued strong resolutions and fewer new delinquencies.

CMBS Special Servicing, Delinquency Rates Dip

Commercial mortgage-backed securities special servicing and delinquency rates both dipped in July, according to Trepp LLC and Fitch Ratings.

CMBS Delinquency Rate Falls Sharply

Trepp LLC, New York, said the commercial mortgage-backed securities delinquency rate posted another large decline in May.

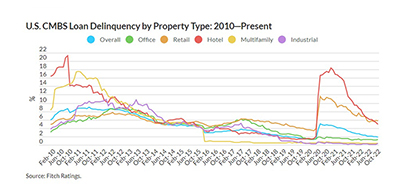

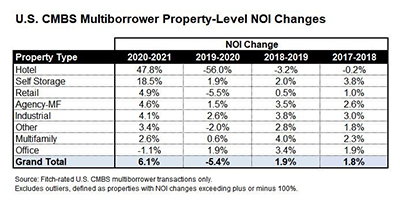

Fitch: CMBS Properties See NOI Recovery

Fitch Ratings, New York, reported property-level net operating income for commercial mortgage-backed securities loans rebounded 6.1 percent on average in 2021.

Grandbridge’s Marcy Thomas Talks CMBS, DEI and CCMS

MBA NewsLink interviewed Marcy Thomas, Vice President and Portfolio Loan Manager with Grandbridge Real Estate Capital LLC, about CMBS servicing, DEI, the upcoming Commercial/Multifamily Finance Servicing and Technology Conference and what the CCMS designation means to her.