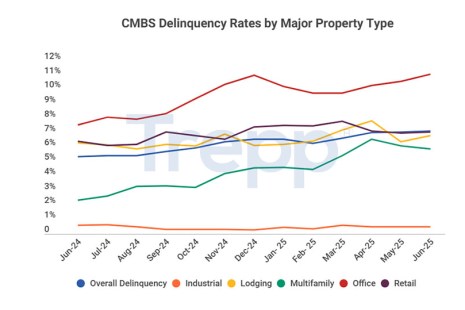

Trepp, New York, reported the CMBS Delinquency Rate increased in January, up 17 basis points to 7.47%.

Tag: CMBS

Trepp: CMBS Delinquency Rate Rises in December

Trepp, New York, reported its CMBS delinquency rate grew in December, up four basis points to 7.3%.

NewsLink Q&A With KBRA: 2026 U.S. CMBS Outlook

MBA NewsLink recently interviewed Kroll Bond Rating Agency’s Larry Kay and Aryansh Agrawal about their 2026 commercial mortgage-backed securities outlook.

Trepp: CMBS Delinquency Rate Rises in October

Trepp, New York, reported its CMBS delinquency rate rose 23 basis points in October to 7.46%.

Fitch: CRE Refinancing Stability Underpinned by Resilient Debt Capital Markets

U.S. commercial real estate loan refinancing remains “resilient,” with ample liquidity absorbing this year’s elevated maturities, according to Fitch Ratings, Chicago/Toronto.

Trepp: CMBS Delinquency Rate Falls for the First Time Since February

Trepp, New York, released the September CMBS Delinquency Rate, finding that it fell six basis points to 7.23%. That’s the first drop since February.

Trepp: CMBS Delinquency Rate Increases for Sixth Straight Month

Trepp, New York, released its CMBS Delinquency report for August, highlighting that the rate increased for the sixth consecutive month.

Trepp Reports CMBS Special Servicing Rate Retreats Slightly

Trepp, New York, reported the commercial mortgage-backed securities special servicing rate dipped in July after peaking at a 12-year high in June.

Trepp: CMBS Delinquency Rate Increases Again in July

Trepp, New York, announced the CMBS Delinquency Rate rose for the fifth straight month in July, up 10 basis points to 7.23%.

Trepp: CMBS Delinquency Rate Up; Office Hits High

Trepp, New York, reported that the CMBS delinquency rate rose in June, up 5 basis points to 7.13%.