As property sale transactions and originations stall, MBA NewsLink interviewed two special servicing executives and a CMBS researcher to get their insights on the commercial real estate finance landscape and outlook.

Tag: CMBS

Commercial Real Estate Reset? A Special Servicing Roundtable

As property sale transactions and originations stall, MBA NewsLink interviewed two special servicing executives and a CMBS researcher to get their insights on the commercial real estate finance landscape and outlook.

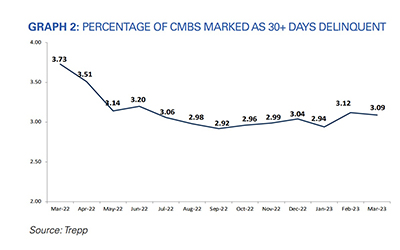

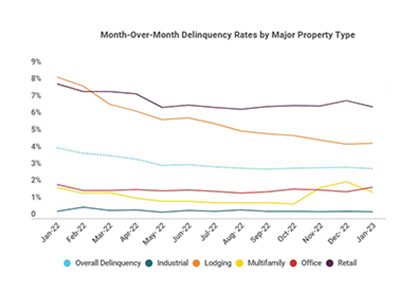

CMBS Delinquency Rate Dips; Offices See Increase

The commercial mortgage-backed securities delinquency rate fell slightly in March, but the segment that everyone watches closely–office–saw its rate move higher again, reported Trepp, New York.

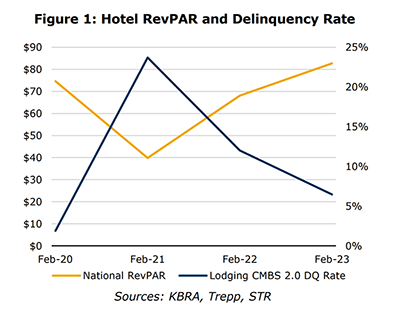

KBRA: Lodging Loan Performance Clouded by Upper-Upscale Chains

U.S. hotels have performed well overall since the pandemic, but upscale properties report higher commercial mortgage-backed securities delinquencies than more modest hotels, reported KBRA, New York.

Moody’s: CMBS Loss Severities Drop

Moody’s, New York, reported U.S. commercial mortgage-backed securities had the lowest loss amount last year since 2009, but noted loss severities remained elevated.

CMBS Supply-Demand Fundamentals Improve Slightly

The outlook for the securitized commercial real estate market improved just slightly in the fourth quarter, the Moody’s Investors Service’s Red-Yellow-Green report said.

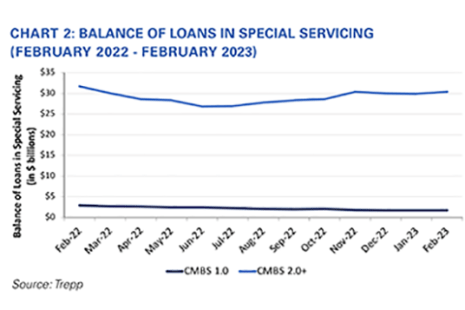

CMBS Delinquency Rate Dips; Special Servicing Rate Increases

Fitch Ratings, New York, reported the commercial mortgage-backed securities delinquency rate decreased two basis points in February to 1.83%.

January CMBS Delinquency Rate Falls Below 3%

Trepp, New York, reported the U.S. commercial mortgage-backed securities delinquency rate fell 10 basis points in January to 2.94%

CMBS Delinquency, Special Servicing Rates Increase

The commercial mortgage-backed securities delinquency and special servicing rates both increased in November, according to Trepp LLC and DBRS Morningstar.

CMBS Supply-Demand Fundamentals Slip

Commercial property market supply and demand fundamentals slipped in the third quarter, reported Moody’s Investors Service, New York.