DBRS Morningstar: CMBS Delinquency Rate Surges

(Chart courtesy of DBRS Morningstar, Toronto.)

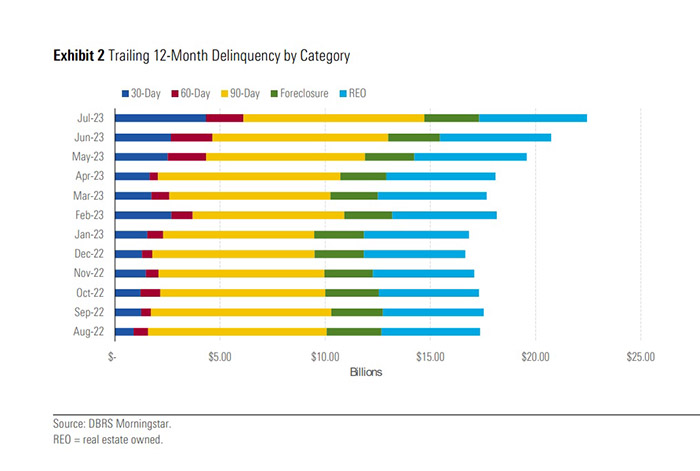

DBRS Morningstar, Toronto, reported the delinquency rate for loans packaged in commercial mortgage-backed securities surged 31 basis points in July. The special servicing rate rose for the fifth straight month, increasing 24 basis points during July.

The CMBS delinquency rate now equals 3.85%, its highest level since February 2022, and the special servicing rate is 7.06%, its highest level since October 2021.

The DBRS Morningstar CMBS Monthly Highlights report noted the CMBS delinquency rate hit a low point of 2.81% in December 2022.

Office loans led special servicing transfer volume, surpassing loans sent to the master servicer for the twelfth consecutive month, DBRS reported. Four of the five major property types posted increases from June.

Distressed property sales remain relatively rare, registering just $214.4 million in July. Distressed property sales have not exceeded $470 million since the summer of 2021. “Many special servicers are opting to hold on to the debt for longer and work out situations with borrowers,” DBRS said.

But pressure on maturing loans continues, especially for office and mall loans. “The maturity payoff rate fell for the fifth straight month, sinking to just 28.6% from 45.4% in June 2023, its lowest level since October 2020,” the report said.

Meanwhile, the year-to-date maturity payoff rate remains at 50.1%. DBRS Morningstar said its 2023 outlook for the maturity payoff rate stands at roughly 50% to 55% “as investors and lenders continue to shy away from maturing office, mall and mixed-use loans. [But] multifamily continues to perform well, posting a better than 95% maturity payoff rate in July,” the report said.