MBA Newslink recently interviewed Malay Bansal, Head of Trading & Capital Markets at 3650 Capital, who shared insights about the CMBS issuer ecosystem and CRE securitization markets.

Tag: CMBS

Trepp: CMBS Special Servicing Rate Jumps in September

Trepp, New York, reported its CMBS Special Servicing Rate rose in September, up 33 basis points to 8.79%.

CMBS Special Servicing Rate Leaps in August, Trepp Finds

Trepp, New York, reported the commercial mortgage-backed securities special servicing rate jumped in August, climbing 16 basis points to 8.46%.

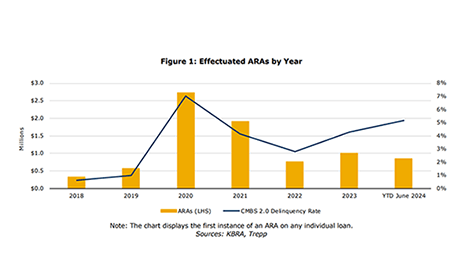

KBRA Says CMBS Appraisal Reductions are Climbing

Kroll Bond Rating Agency, New York, reported that commercial mortgage-backed securities appraisal reduction amounts–ARAs–have climbed in tandem with delinquency rates.

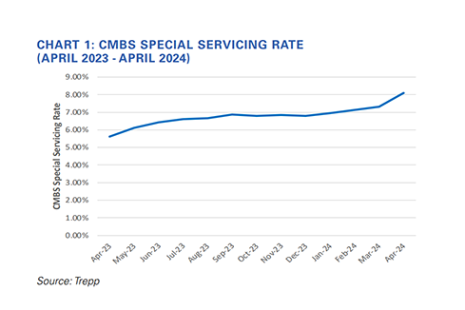

Trepp: CMBS Special Servicing Rate Jumps in April

Trepp, New York, reported the commercial mortgage-backed securities special servicing rate “leaped” in April, rising 80 basis points to reach 8.11%.

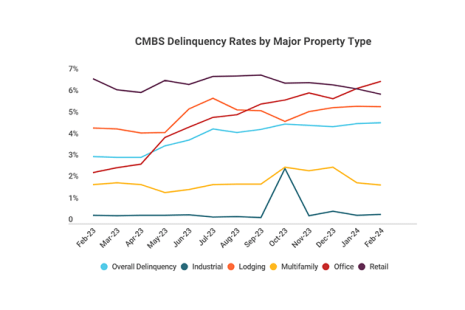

CMBS Delinquency Rate Increases Moderately

The delinquency rate among KBRA-rated U.S. commercial mortgage-backed securities increased moderately in April to 4.67%, according to KBRA, New York.

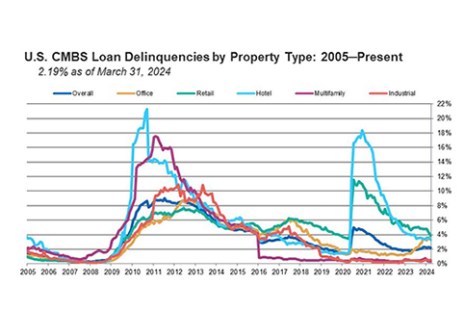

High Resolution Volume Drives CMBS Delinquency Rate Lower, Fitch Reports

The U.S. commercial mortgage-backed securities delinquency rate decreased nine basis points to 2.19% in March, according to Fitch Ratings, New York.

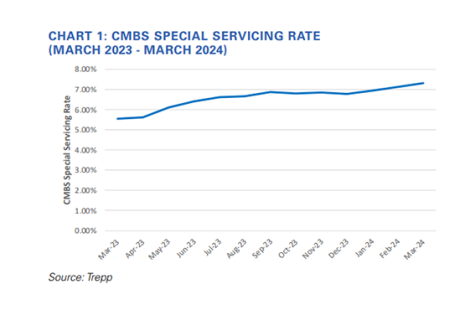

CMBS Special Servicing Rate Jumps: Trepp

Trepp, New York, reported the commercial mortgage-backed securities special servicing rate jumped 17 basis points in March to 7.31%.

Moody’s Reports Higher Interest Rates Driving Down Defeasance

Moody’s Investors Service, New York, reported commercial mortgage-backed securities defeasance activity tumbled last year to $11.4 billion from $32.2 billion in 2022.

Office Sector Drives CMBS Delinquency Rate Up Slightly: Trepp

The delinquency rate for commercial mortgage-backed securities inched upward in February, according to Trepp, New York.