Housing starts posted a modest increase in April, the Census Bureau and HUD reported Wednesday.

Tag: Wells Fargo Economics

Inflation Slows to Two-Year Low

Consumer prices rose by 0.4 percent in April to 4.9 percent annually, the slowest annual inflation rate since April 2021, the Bureau of Labor Statistics reported Wednesday.

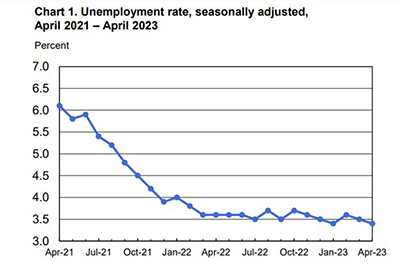

April Employment Beats Expectations

The U.S. economy added 253,000 jobs in April, and the unemployment rate fell again to match a 53-year low, beating analyst expectations, the Bureau of Labor Statistics reported Friday.

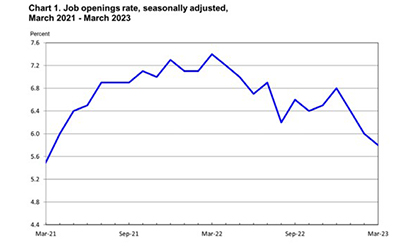

Job Openings Fall to 2-Year Low

In the first of four major jobs reports this week, the Bureau of Labor Statistics reported job openings fell to their lowest level since April 2021.

March Construction Spending Up 0.3%

Construction spending in March rose by 0.3 percent from February and by nearly 4 percent from a year ago, the Census Bureau reported Monday.

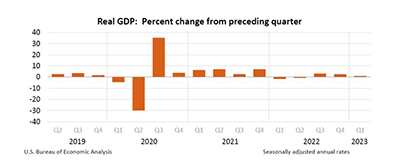

First Quarter GDP Slows to 1.1%

The U.S. economy marked its slowest growth in nearly a year, the Bureau of Economic Analysis reported Thursday.

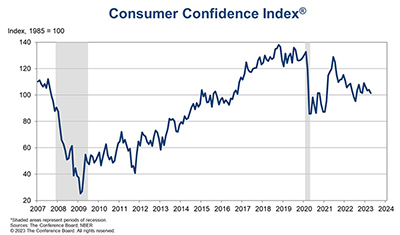

Consumer Confidence at 6-Month Low

The Conference Board, New York, said its Consumer Confidence Index fell to its lowest level since last November.

With Homeowners Sitting, Buyers Turn to New Homes

March new home sales jumped by nearly 10 percent from February, HUD and the Census Bureau reported Tuesday, as home buyers turned away from existing home sales.

March Existing Home Sales Down 2.4%

Existing home sales edged lower in March, marking a muted start to the spring housing market, the National Association of Realtors reported Thursday.

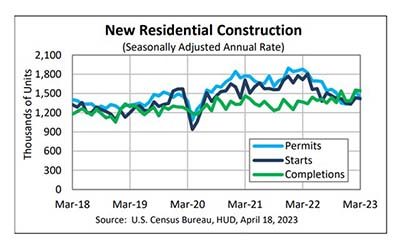

March Housing Starts Down 1%; Single-Family Starts, Permits, Completions Up

Housing starts fell by 0.8 percent in March, the Census Bureau and HUD reported Tuesday, although single-family starts, permits and completions all rose amid growing home builder sentiment.