April Employment Beats Expectations

The U.S. economy added 253,000 jobs in April, and the unemployment rate fell again to match a 53-year low, beating analyst expectations, the Bureau of Labor Statistics reported Friday.

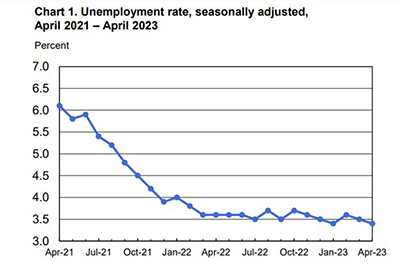

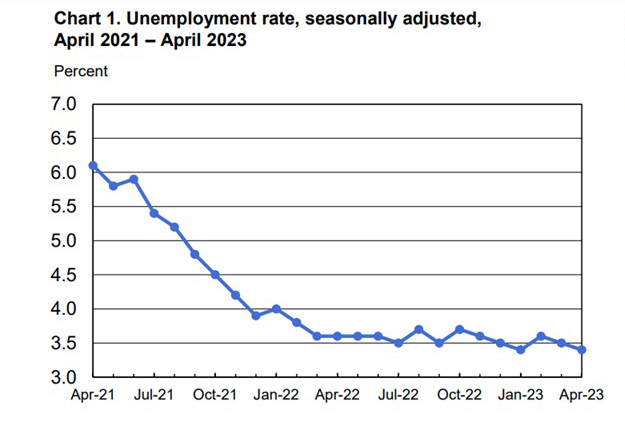

The report said the unemployment rate fell by 0.1 percent to 3.4 percent, matching the lowest rate since 1970, as employment continued to trend up in professional and business services, health care, leisure and hospitality and social assistance. Consensus analyst forecasts had anticipated just 180,000 new jobs and the unemployment rate to rise to 3.6 percent. The unemployment rate has hovered between 3.4 percent and 3.7 percent since March 2022.

The change in total nonfarm payroll employment for February was revised down by 78,000, from +326,000 to +248,000, and the change for March was revised down by 71,000, from +236,000 to +165,000. Despite this, the U.S. added 236,000 jobs in March, 311,000 jobs in February and 504,000 jobs in January.

Both the labor force participation rate, at 62.6 percent, and the employment-population ratio, at 60.4 percent, were unchanged in April. These measures remain below their pre-pandemic February 2020 levels (63.3 percent and 61.1 percent, respectively).

“On net, the labor market is stronger than expected,” said Mike Fratantoni, Chief Economist with the Mortgage Bankers Association. “As was the case in recent months, job growth remains concentrated in just a few sectors, particularly health care and hospitality. Although we have seen several public layoff announcements, the job growth in these few sectors continues to offset losses in technology and other industries, including the mortgage market.”

Fratantoni said a continued solid job market will provide support to the housing market. “However, the inflationary pressures from this strong wage growth will likely prevent the Federal Reserve from cutting rates any time soon, even if they now are at the peak for this rate cycle,” he said.

including wage growth up 4.4% over the past year. This rate of growth is likely faster than would be consistent with the Federal Reserve’s 2% inflation target.

“The ongoing strength of hiring is keeping the labor market extraordinarily tight even as the supply picture has improved in recent months,” said Sarah House, Senior Economist with Wells Fargo Economics, Charlotte, N.C. “While the jobs market has remained incredibly resilient, clouds continue to gather. Hiring momentum has slowed, with deteriorating demand for workers pointing to more pronounced weakening ahead. We look for job growth to slow more meaningfully in the second half of the year and into 2024 as the lagged effect of monetary policy tightening bites.”

“Despite the 500-basis point increase in the federal funds rate over the past 14 months, the labor market remains strong,” said Odeta Kushi, Deputy Chief Economist with First American Financial Corp., Santa Ana, Calif. “The trend is still slower hiring, but the slowdown is very gradual.”

Kushi said the Fed’s hope is to architect a soft landing, such that tighter monetary policy will reduce job openings without big increases in unemployment. “If you’re looking for signs of a recession in the labor market data, you won’t find it in this report – a ‘soft landing’ is still on the table,” she said. “According to the latest JOLTS report, there were 9.6 million job openings in March, a 20 percent decline from the March 2022 peak. However, job openings remained 37 percent higher than in February 2020, and job openings exceeded total hires by 3.4 million, indicating that employers are still struggling to fill vacancies as labor demand outstrips supply.”

Kushi added while the housing industry, a very interest-rate sensitive sector, has been negatively impacted by the Federal Reserve’s monetary tightening, the construction labor market has not experienced a sharp decline. The report noted residential building construction employment is up 1.3% year over year, while non-residential is up by 3.4%. Residential building is up 11% compared with pre-pandemic levels, while non-residential building is up 0.5%.

“Despite declines in the number of single-family homes under construction, residential construction labor demand remains strong,” Kushi said. “Building a home does not readily lend itself to outsourcing and automation. Home building still requires manual labor as a key input into the production process. There are still a near-record number of homes under construction, and you need more hammers at work to build these homes. Additionally, builders have had trouble attracting and retaining skilled construction workers, making them less likely to part with skilled workers.”

The report said average hourly earnings for all employees on private nonfarm payrolls rose by 16 cents, or 0.5 percent, to $33.36. Over the past 12 months, average hourly earnings have increased by 4.4 percent. Average hourly earnings of private-sector production and nonsupervisory employees rose by 11 cents, or 0.4 percent, to $28.62.

“This rate of growth is likely faster than would be consistent with the Federal Reserve’s 2% inflation target,” Fratantoni said.

BLS said the average workweek for all employees on private nonfarm payrolls was unchanged at 34.4 hours in April. In manufacturing, the average workweek was little changed at 40.2 hours, and overtime remained at 2.9 hours. The average workweek for production and nonsupervisory employees on private nonfarm payrolls edged down by 0.1 hour to 33.8 hours.