Inflation Slows to Two-Year Low

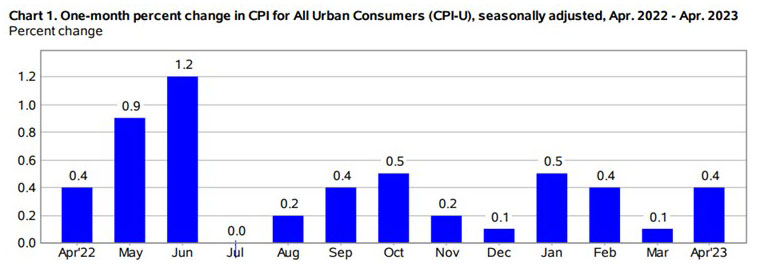

Consumer prices rose by 0.4 percent in April to 4.9 percent annually, the slowest annual inflation rate since April 2021, the Bureau of Labor Statistics reported Wednesday.

The Consumer Price Index rose by 0.4 percent in April on a seasonally adjusted basis, after increasing 0.1 percent in March. Over the past 12 months, the all-items index increased by 4.9 percent before seasonal adjustment.

The index for shelter was the largest contributor to the monthly all-items increase, followed by increases in the index for used cars and trucks and the index for gasoline. The increase in the gasoline index more than offset declines in other energy component indexes—the energy index rose 0.6 percent in April. The food index was unchanged in April, as it was in March. The index for food at home fell 0.2 percent over the month, while the index for food away from home rose 0.4 percent.

The index for all items less food and energy rose by 0.4 percent in April, as it did in March. Indexes that increased in April include shelter, used cars and trucks, motor vehicle insurance, recreation, household furnishings and operations and personal care. The index for airline fares and the index for new vehicles were among those that decreased over the month.

The all-items index increased by 4.9 percent for the 12 months ending April; this was the smallest 12-month increase since the period ending April 2021. The all-items less food and energy index rose 5.5 percent over the past 12 months. The energy index decreased 5.1 percent for the 12 months ending April, while the food index increased 7.7 percent over the last year.

“The April CPI report was largely in line with forecasters’ expectations,” said Sarah House, Senior Economist with Wells Fargo Economics, Charlotte, N.C. “On balance, today’s report does not materially change our outlook for inflation or Fed policy. We expect the FOMC to maintain the federal funds rate at its current level for the foreseeable future and for inflation to slow further in the months ahead as supply pressures continue to ease and demand growth weakens.”