April Housing Starts Up 2.2%

Housing starts posted a modest increase in April, the Census Bureau and HUD reported Wednesday.

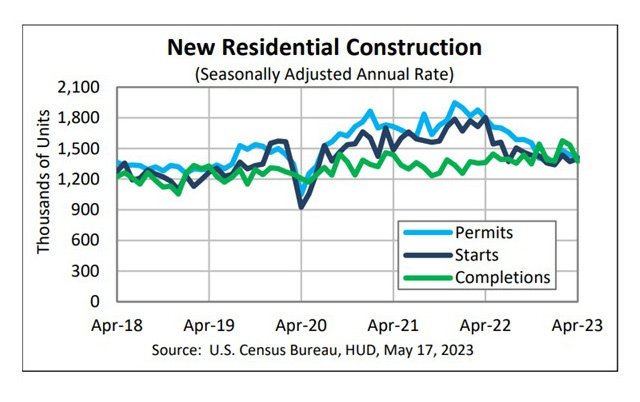

The report said privately owned housing starts in April rose to a seasonally adjusted annual rate of 1,401,000, 2.2 percent higher than the revised March estimate of 1,371,000, but 22.3 percent lower than a year ago (1,803,000). Single‐family housing starts rose to 846,000; 1.6 percent higher than the revised March figure of 833,000. The April rate for units in buildings with five units or more rose to 542,000, up by 5.2 percent from March but down by 11.7 percent from a year ago.

Regionally, results were mixed. In the largest region, the South, starts fell by 6.3 percent in April to 784,000 units, seasonally annually adjusted, from 837,000 units in March and fell by nearly 24 percent from a year ago. In the Northeast, starts fell by 23.4 percent in April to 131,000 units from 171,000 units in March and fell by 2.2 percent from a year ago.

However, those losses were more than offset by gains in the West and Midwest. In the West, starts rose by 34.6 percent in April to 315,000 units, seasonally annually adjusted, from 234,000 units in March but fell by 25.5 percent from a year ago. in the Midwest, starts jumped by 32.6 percent to 171,000 units in April from 129,000 units in March but fell by nearly 22 percent from a year ago.

“Single-family housing starts have improved modestly alongside cautious builder optimism, as homebuilder sentiment inched into positive territory in May, increasing for the fifth consecutive month,” said Odeta Kushi, Deputy Chief Economist with First American Financial Corp., Santa Ana, Calif. “The month-over-month data showed a modest improvement in single-family homebuilding. Permits, a leading indicator of future starts are up 3.1% month over month and single-family starts were up 1.6% month over month, so more groundbreaking on new homes. Single-family completions were down 6.5% on a monthly basis, meaning less new housing supply added to the overall housing stock.”

Kushi noted existing home inventory remains limited as the majority of homeowners are rate-locked into their homes. “As a result, prospective buyers may turn to the new home market,” she said. “If finding an existing home is difficult, a new home at the right price is a good substitute.”

Kushi added estimates of the nation-wide housing shortage vary, but tend to range from between 3.5 million to 5.5 million housing units. “This implies that even if all units under construction came to market tomorrow, we’d still be underbuilt by millions of units,” she said. “As such, new supply of housing is more likely to ease than erase the national housing shortage, although this will vary by location.”

“Home building appears to be perking up a bit,” said Charlie Dougherty, Economist with Wells Fargo Economics, Charlotte, N.C. “In particular, single-family construction now appears to be on the rebound. Compared to the sharp upshift in activity experienced post-pandemic, single-family construction is still running at a relatively sluggish pace. However, April’s gain in single-family starts was complemented by a third consecutive improvement in single-family permits.”

Dougherty noted “remarkably low” resale inventory has become another tailwind, as discouraged buyers increasingly look to the new home market for a home to purchase. “All told, the improving trends in permits and builder confidence are encouraging signs that home builders are now working off a more stable foundation,” he said.

Building Permits

The report said privately owned housing units authorized by building permits in April fell to a seasonally adjusted annual rate of 1,416,000, 1.5 percent below the revised March rate of 1,437,000 and 21.1 percent lower than a year ago (1,795,000). Single‐family authorizations in April fell to 855,000, 3.1 percent above the revised March figure of 829,000. Authorizations of units in buildings with five units or more fell to 502,000 in April, down by nearly 10 percent from Mary and down by 23 percent from a year ago.

Housing Completions

Privately owned housing completions in April fell to a seasonally adjusted annual rate of 1,375,000, 10.4 percent below the revised March estimate of 1,534,000, but 1 percent higher than a year ago (1,361,000). Single‐family housing completions in April fell to 971,000, 6.5 percent below the revised March rate of 1,039,000. The April rate for units in buildings with five units or more fell to 400,000, down by 17.4 percent from March but up by 24.2 percent from a year ago.

More housing reports come out Thursday and Friday. On Thursday, the National Association of Realtors releases its April Existing Home Sales report. And on Friday, the Mortgage Bankers Association releases its monthly Builder Applications Survey, with commentary from MBA Vice President and Deputy Chief Economist Joel Kan.