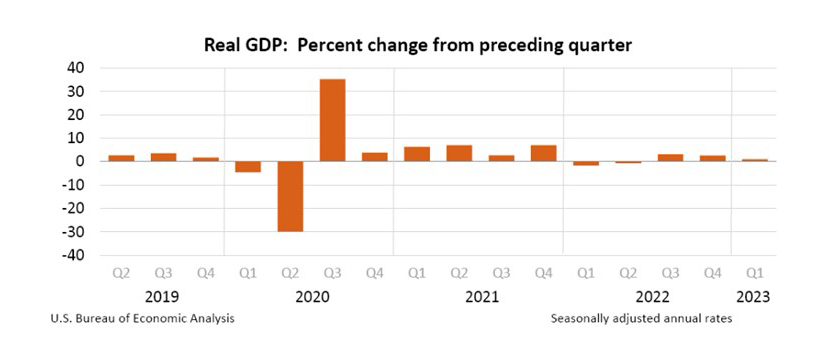

First Quarter GDP Slows to 1.1%

The U.S. economy marked its slowest growth in nearly a year, the Bureau of Economic Analysis reported Thursday.

BEA said its first (advance) estimate of first quarter real gross domestic product showed an increase at an annual rate of 1.1 percent. In the fourth quarter, real GDP increased by 2.6 percent.

The increase in real GDP reflected increases in consumer spending, exports, federal government spending, state and local government spending and nonresidential fixed investment, partly offset by decreases in private inventory investment and residential fixed investment. Imports, a subtraction in the calculation of GDP, increased.

BEA said the increase in consumer spending reflected increases in both goods and services. Within goods, the leading contributor was motor vehicles and parts. Within services, the increase was led by health care and food services and accommodations. Within exports, an increase in goods (led by consumer goods, except food and automotive) was partly offset by a decrease in services (led by transport). Within federal government spending, the increase was led by non-defense spending. The increase in state and local government spending primarily reflected an increase in compensation of state and local government employees. Within nonresidential fixed investment, increases in structures and intellectual property products were partly offset by a decrease in equipment.

The decrease in private inventory investment was led by wholesale trade (notably, machinery, equipment and supplies) and manufacturing (led by other transportation equipment as well as petroleum and coal products). Within residential fixed investment, the leading contributor to the decrease was new single-family construction. Within imports, the increase reflected an increase in goods (mainly durable consumer goods and automotive vehicles, engines and parts).

BEA said compared to the fourth quarter, deceleration in real GDP in the first quarter primarily reflected a downturn in private inventory investment and a slowdown in nonresidential fixed investment. These movements were partly offset by an acceleration in consumer spending, an upturn in exports and a smaller decrease in residential fixed investment. Imports increased slightly.

“First-quarter GDP data indicated that the economy was still in growth mode, albeit at a slower rate,” said Joel Kan, Vice President and Deputy Chief Economist with the Mortgage Bankers Association. “The economy grew at a pace of 1.1 percent – the weakest in three quarters – but was driven by consumer spending, business investment and government spending. Consumer spending continued to prop up overall growth, as spending on goods registered growth after four quarters of declines, and spending on services also increased relative to the previous quarter. Drags to growth came mainly from declining inventory investment and residential fixed investment. Residential investment has shown eight quarters of declines but has improved over the past two quarters.”

Kan noted continuing growth in the economy, coupled with a strong job market and inflation that is still too high – the first quarter PCE index showed 4 percent growth, double the Fed’s target – will likely lead the Fed to raise the federal funds rate one more time at its next meeting, even as credit conditions tighten due to challenges and uncertainty in the banking sector. “They are expected to then hold the funds rate at this higher level at least through the end of 2023,” he said.

MBA expects a recovery in residential investment to occur later in the year as purchase conditions improve. “We forecast a short recession in the coming quarters, as these tighter financial conditions exert a drag on consumer and business activity through tighter lending conditions and higher rates,” Kan said. “This will cause the unemployment rate to rise and gradually lower inflation closer to the Fed’s 2 percent target by the end of 2024.”

“Monthly data suggest that consumer spending has lost momentum over the past few months,” said Jay Bryson, Chief Economist with Wells Fargo Economics, Charlotte, N.C. “Moreover, consumers are relying increasingly on credit and stockpiled cash to finance their purchases. These factors are not sustainable, in our view. We continue to forecast that the U.S. economy to slip into recession, which we expect will be of moderate severity, in the second half of the year.”