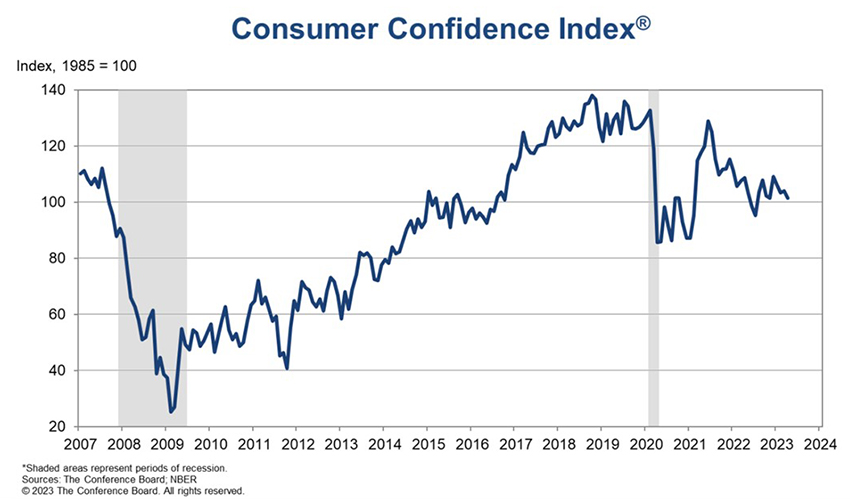

Consumer Confidence at 6-Month Low

The Conference Board, New York, said its Consumer Confidence Index fell to its lowest level since last November.

The index fell in April to 101.3, down from 104.0 in March. The Present Situation Index—based on consumers’ assessment of current business and labor market conditions—increased to 151.1 from 148.9 last month. The Expectations Index—based on consumers’ short-term outlook for income, business and labor market conditions—fell to 68.1 from 74.0. The Expectations Index has now remained below 80—the level associated with a recession within the next year—every month since February 2022, with the exception of a brief uptick in December 2022.

“While consumers’ relatively favorable assessment of the current business environment improved somewhat in April, their expectations fell and remain below the level which often signals a recession looming in the short-term,” said Ataman Ozyildirim, Senior Director, Economics with The Conference Board. “Consumers became more pessimistic about the outlook for both business conditions and labor markets. Compared to last month, fewer households expect business conditions to improve and more expect worsening of conditions in the next six months. They also expect fewer jobs to be available over the short term. April’s decline in consumer confidence reflects particular deterioration in expectations for consumers under 55 years of age and for households earning $50,000 and over.”

Meanwhile, Ozyildirim noted, April’s results show consumer inflation expectations over the next 12 months remain essentially unchanged from March at 6.2 percent—although that level is down substantially from the peak of 7.9 percent reached last year, it is still elevated. “Overall purchasing plans for homes, autos, appliances and vacations all pulled back in April, a signal that consumers may be economizing amid growing pessimism,” he said.

“In recent weeks and months there has been a lot with which to contend: financial turmoil culminating in bank failures, the latest in a string of rate hikes that outpaces any tightening cycle in the past 40 years and the combined effect that these developments have had on the cost and availability of credit,” said Tim Quinlan, Senior Economist with Wells Fargo Economics, Charlotte, N.C. “To the extent that there was good news in today’s report it is that the present situation index rose slightly to 151.1 in April; that is roughly the midpoint of where it has been for the past year. Whatever else may be weighing on them, consumers remain upbeat about the labor market and business conditions both of which improved, if only slightly, during the month.”

Quinlan noted the transition to a buyers’ market from the sellers’ market of the last few years is at last underway, as buyers cut back on plans to make large purchases and firms look for ways to incentivize purchases. “This is broadly in line with headlines over the past few weeks in which automakers have announced price cuts on various new auto models,” he said. “It is important to note, however, that consumer purchase plans do not always translate into the hard data…Take consumer purchase plans with a grain of salt.”

The report said consumers’ assessment of current business conditions improved somewhat in April: 18.8% of consumers said business conditions were “good,” same as last month. However, 18.1% said business conditions were “bad,” down from 19.3%.

Consumers’ appraisal of the labor market improved slightly: 48.4% of consumers said jobs were “plentiful,” up slightly from 47.9%, while 11.1% of consumers said jobs were “hard to get,” down slightly from 11.4% last month.

Consumers became more pessimistic about the short-term business conditions outlook in April: 13.5% of consumers expect business conditions to improve, down from 16.4%. And 21.5% expect business conditions to worsen, up from 19.2%.

Consumers’ assessment about the short-term labor market outlook was less positive: 12.5% of consumers expect more jobs to be available, down from 15.5%, while 21.0% anticipate fewer jobs, up slightly from 20.5%.

Consumers’ short-term income prospects was, on balance, somewhat more favorable:

15.7% of consumers expect their incomes to increase, down slightly from 16.2% last month, while 11.6% expect their incomes will decrease, down from 13.8% last month.