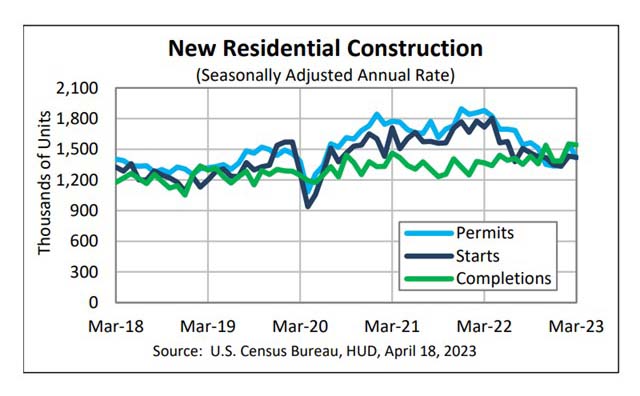

March Housing Starts Down 1%; Single-Family Starts, Permits, Completions Up

Housing starts fell by 0.8 percent in March, the Census Bureau and HUD reported Tuesday, although single-family starts, permits and completions all rose amid growing home builder sentiment.

The report said privately owned housing starts in March fell to a seasonally adjusted annual rate of 1,420,000, 0.8 percent lower than the revised February estimate of 1,432,000 and 17.2 lower than a year ago (1,716,000). Single‐family housing starts rose to 861,000, is 2.7 percent higher than the revised February figure of 838,000. The March rate for units in buildings with five units or more fell to 542,000, down by 6.7 percent from February but up by 6.1 percent from a year ago.

Regionally, results were all over the charts. In the largest region, the South, starts rose by 6.8 percent to 848,000 units in March, seasonally annually adjusted, from 794,000 units in February and rose by 0.2 percent from a year ago. In the West, however, starts plunged by 28.1 percent in March to 258,000 units from 359,000 units in February and fell by 38.6 percent from a year ago.

\Similarly, in the Northeast, starts jumped by 72.4 percent in March to 181,000 units, seasonally annually adjusted, from 105,000 units in February but fell by 14.2 percent from a year ago. This was more than offset by the Midwest, where starts fell by 23.6 percent in March to 133,000 units from 174,000 units in February and fell by 44.4 percent from a year ago.

“Single-family housing permits, starts and completions were all up on a month-over-month basis,” said Odeta Kushi, Deputy Chief Economist with First American Financial Corp., Santa Ana, Calif. “This is consistent with the rise in homebuilder sentiment, which ticked up for the fourth consecutive month in April, with two of the three components – current single-family sales and single-family sales expectations – rising.”

“The uptick in single-family construction arrives alongside slightly lower mortgage rates and incentive programs, which have attracted affordability-crunched buyers from the sidelines,” said Charlie Dougherty, Economist with Wells Fargo Economics, Charlotte, N.C. “Low existing single-family inventories and easing material prices have been other tailwinds.”

Kushi said while builders still face several supply-side issues, in addition to a volatile mortgage rate environment, “there is reason for cautious optimism. Notably, builders are responding to the recent decline in mortgage rates and the persistent lack of existing-home inventory. New-home inventory now makes up 27% of total inventory. Historically, that share was more like 11%. When existing homes for sale are nearly non-existent, a new home at the right price may be an attractive option.”

Having said that, Kushi noted, “Plenty of headwinds remain for the new-home sector – mortgage rate uncertainty, higher costs, and ongoing supply-side challenges. While there was some positive news for single-family homebuilding this month, it’s not yet clear if a sustained recovery is on the horizon.”

“Demand for housing proves to be more resilient than we had previously expected,” said Doug Duncan, Chief Economist with Fannie Mae, Washington, D.C. “The supply of existing homes remains constrained both because of a decade of underbuilding following the Great Financial Crisis and, more recently, the lock-in effect discouraging current homeowners from listing their homes for sale (and thus giving up their low mortgage rate). As such, in light of an extremely limited supply of existing homes for sale, many homebuyers are turning to new homes.”

Duncan said this phenomenon coincides with lower building materials costs compared to a year ago, which allows homebuilders to offer stronger concessions and rate buy-downs while maintaining profit margins.” Still, with the generally more indicative single-family permits continuing to trend below starts (despite a 4.1 percent increase to a SAAR of 818,000) and our forecast for a modest recession beginning in the second half of this year, we continue to expect a pullback in single-family construction as the year progresses.”

“Multifamily construction continues to run at a robust clip,” Dougherty said. “The 559K unit pace of construction registered in March was down over the month, but still stronger than the annual pace hit in 2022 as a whole. What’s more, the count of multifamily units currently under construction ticked up to 958K in March, a high not seen since 1973. Given the substantial amount of new multifamily supply set to deliver over the next few years, it seems likely that a slowdown in construction is ahead. Apartment vacancy rates have trended higher in recent months and weaker rental demand could push vacancy rates higher. On the other hand, a structural shortfall of single-family homes could bolster multifamily demand.”

Building Permits

The report said privately owned housing units authorized by building permits in March fell to a seasonally adjusted annual rate of 1,413,000, 8.8 percent below the revised February rate of 1,550,000 and 24.8 percent below the March 2022 rate of 1,879,000. However, single‐family authorizations in March rose to 818,000; 4.1 percent above the revised February figure of 786,000. Authorizations of units in buildings with five units or more fell to 543,000 in March, down by 24.3 percent from February and by nearly 18 percent from a year ago.

“Single-family permits are a leading indicator of future starts, which leads to more groundbreaking on new homes and more single-family completions, ultimately adding net new supply to the housing stock,” Kushi said. “Good news for a supply-starved market.”

Housing Completions

Privately owned housing completions in March fell to a seasonally adjusted annual rate of 1,542,000, 0.6 percent below the revised February estimate of 1,552,000, but 12.9 percent higher than a year ago (1,366,000). Single‐family housing completions in March rose to 1,050,000; 2.4 percent higher than the revised February rate of 1,025,000. The March rate for units in buildings with five units or more fell to 484,000, 7.1 percent lower than February (521,000) but nearly 60 percent higher than a year ago.

“Completions have outpaced starts since July 2022 and that will continue to put downward pressure on the number of single-family homes under construction,” Kushi said. “As new, completed home inventory rises, it will provide some relief to a supply-starved market and put downward pressure on new-home prices.”