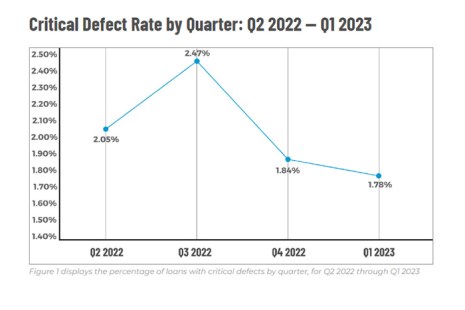

ACES Quality Management, Denver, reported the overall critical defect rate for the first quarter of 2023 was 1.78%. That’s down 3.26% from the previous quarter, and the second straight quarter of declines.

Tag: Nick Volpe

3Q Critical Defect Rate Posts Series High

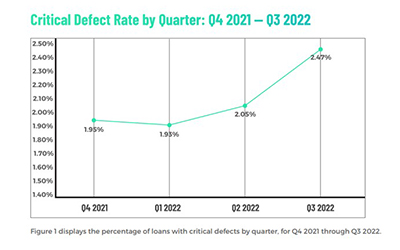

ACES Quality Management, Denver, said the overall critical defect rate for mortgage underwriting in the third quarter rose to a series high.

ACES: Critical Defect Rates Up 6%

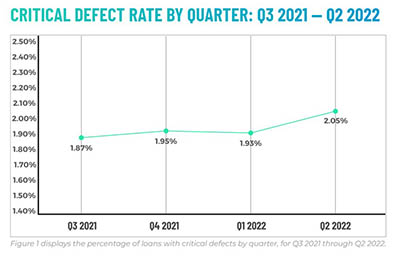

ACES Quality Management, Denver, issued its quarterly Mortgage QC Industry Trends Report, showing the overall critical defect rate increased by 6% in the second quarter to 2.05%, crossing the 2% threshold for only the third time in this report’s history.

Critical Defect Rate Falls for 2nd Straight Quarter

ACES Quality Management, Denver, said the overall critical defect rate declined for the second straight quarter despite a more challenging mortgage lending environment.

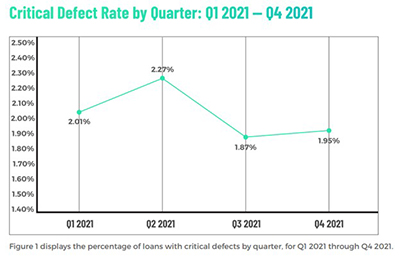

ACES: 4Q Critical Defect Rate Rises to 1.95%

The company’s Q4 Mortgage QC Industry Trends Report found the overall critical defect increased 0.08% to 1.95%, a change of 4% from the prior quarter, as lenders transitioned to a purchase-heavy lending environment.

Critical Defect Rate Down 18%

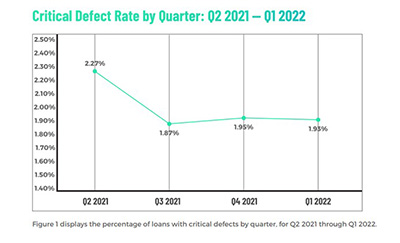

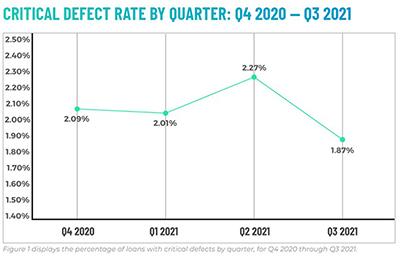

ACES Quality Management, Denver, said mortgage lenders managed loan origination quality “extremely well” in the third quarter, leading to an 18% improvement in overall credit defect rates.

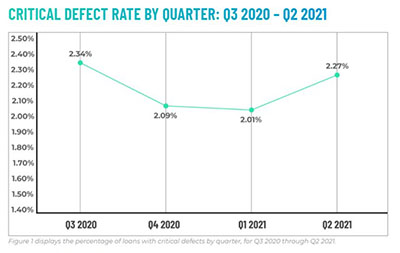

ACES: Q2 Critical Defect Rate Up 13%

ACES Quality Management, Denver, reported a13% increase in overall critical defect rates to 2.27%, ending a multi-quarter trend of improvement.

Housing Market Roundup Sept. 21, 2021

It’s another busy week for housing reports—and it’s only Tuesday! Here are some reports of interest that crossed the MBA NewsLink desk:

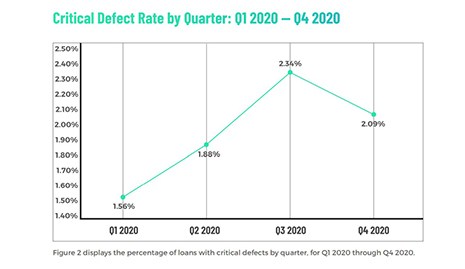

ACES: Q4 Critical Defect Rate Moderates, But Remains High

ACES Quality Management, Denver, said overall critical defect rates improved in the fourth quarter but remained high for calendar year 2020.

Nick Volpe: A Brief History of Defects; Q3 2020’s Loan Quality Performance Sets Stage for Areas of Concern in 2021

Given the necessary delay that must precede the analysis of post-closing data, it is easy to forget the significance of these findings. However, mistakes made in the past often do not remain so, especially when those mistakes go unaddressed. Thus, lenders have a great deal to learn from their post-closing quality control analyses, even more so given the market disruptions and macroeconomic impact of COVID-19.