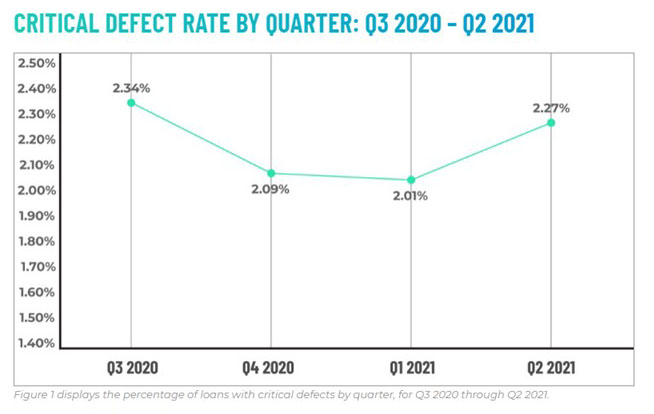

ACES: Q2 Critical Defect Rate Up 13%

ACES Quality Management, Denver, reported a13% increase in overall critical defect rates to 2.27%, ending a multi-quarter trend of improvement.

The company’s second-quarter Mortgage QC Trends Report said the Income/Employment defect category reached its highest observed rate since the inception of this report in 2016. It also noted improvement in several core underwriting categories as well as in manufacturing-related categories, most likely driven by more predictable and stable volumes.

The report also noted a significant shift in reviews of refinance versus purchase transactions, further signaling that the transition from a refinance market to a purchase market is well underway. It reported an increased share and improved performance for conventional loans and a decline in Early Payment Defaults, suggesting reviews have peaked and are now below pre-pandemic levels.

“Several factors contributed to the increase in the critical defect rate to 2.27% in Q2 of 2021, including the transition from a refinance market to a purchase market, the previous quarter’s falling margins, eviction moratorium uncertainty and rising inflation,” said ACES Executive Vice President Nick Volpe. “As the market continues to transition to primarily purchase transactions, lenders should expect continued volatility over the next few quarters and, therefore, keep a close watch on defects for the foreseeable future.”

Findings for report are based on post-closing quality control data derived from the ACES Quality Management and Control benchmarking system and incorporate data from prior quarters and/or calendar years.

“While the increase in the critical defect rate was disappointing, there are several silver linings to our Q2 findings, including volume stabilization and declining unemployment numbers,” said ACES CEO Trevor Gauthier. “These, combined with other economic factors, provide some optimism for the coming quarters, though the possible effect of inflation on interest rates may dampen that outlook. Given the uncertainty of 2022’s market and increasing regulatory pressures, lenders must ensure their existing QC and compliance programs are leveraging automation to maximize loan quality and mitigate risk.”