Critical Defect Rate Down 18%

MBA NewsLink Staff

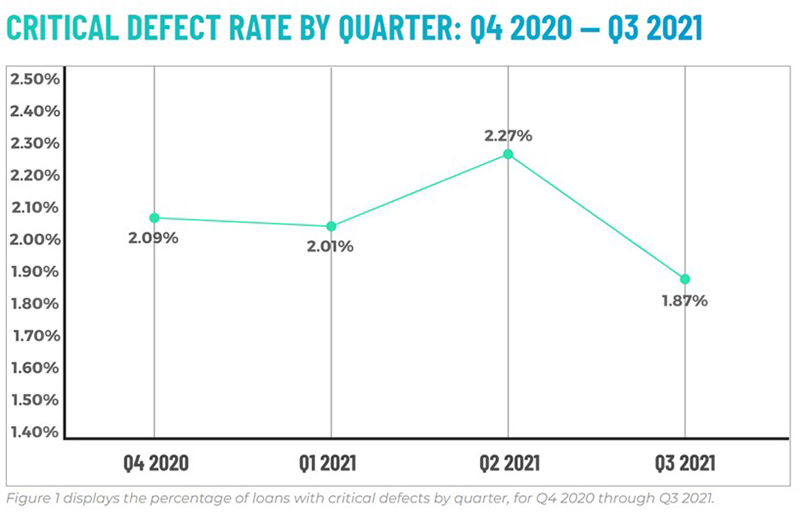

ACES Quality Management, Denver, said mortgage lenders managed loan origination quality “extremely well” in the third quarter, leading to an 18% improvement in overall credit defect rates.

The quarterly ACES Mortgage QC Trends Report for third quarter 2021 said the critical defect rate fell to 1.86%. It also reported manufacturing-related loan defects decreased as volumes declined. Defect performance on conventional loans stabilized while FHA defects rose. The Early Payment Defaults trend line indicates that reviews peaked and are now below pre-pandemic levels, shifting the focus to the remaining loans in forbearance status and exit plans for those borrowers.

ACES Executive Vice President Nick Volpe noted the third quarter marked a shift from refinances to a purchase-driven market, with purchase defects increasing as a result.

“Metrics are beginning to trend back to their historic normal levels as volume moderates,” Volpe said. W”ith the amount of volatility in macroeconomic factors and rising rates, the decline in the overall critical defect rate is a testament to lenders taking quality management and control seriously.”

“An improvement in the critical defect rate is always a positive sign,” said ACES CEO Trevor Gauthier. “The worst of early payment default volume seems to be behind us, but we’re not out of the woods yet. Lenders’ focus should continue to be on helping remaining loans in forbearance status and building exit plans for those borrowers.”

Gauthier added lenders and banks need to be cognizant of economic and geopolitical environments in the coming months and possibly years. “As the Federal Reserve works to calm inflation, these actions oftentimes have a ripple effect, which can certainly impact loan quality,” he said.