3Q Critical Defect Rate Posts Series High

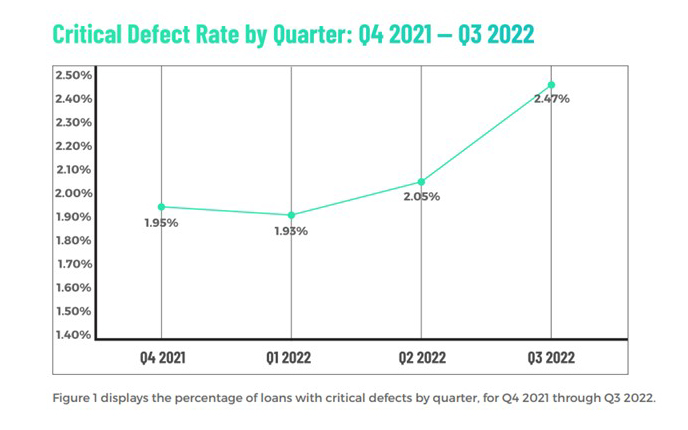

ACES Quality Management, Denver, said the overall critical defect rate for mortgage underwriting in the third quarter rose to a series high.

The company’s quarterly Mortgage QC Industry Trends Report covering the third quarter found the overall critical defect rate increased by 20.5% over the second quarter, ending at 2.47% – a report high. Of the four major underwriting categories (Assets, Credit, Income/Employment and Liabilities), three saw moderate to significant increases from the second quarter. Income/Employment remained the leading category of defects reported, despite continuing its multi-quarter trend of decline.

“The overarching theme for this quarter’s report is the effect of sharp declines in loan volume and interest rate volatility on lenders’ operations,” said ACES Executive Vice President Nick Volpe. “With purchase originations down nearly 20% quarter-over-quarter and close to 50% year-over-year, lenders are fighting to keep every potential piece of business that comes their way and, perhaps, becoming more aggressive in their borrower qualifications Riding the line on eligibility provides little margin for error. Thus, lenders must continue emphasizing loan quality to ensure salability and long-term asset performance.”

ACES CEO Trevor Gauthier noted as layoffs continued, “we’re seeing the ripple effects of interest rate volatility and changing market conditions surface in other areas of the loan manufacturing process, particularly in eligibility.”