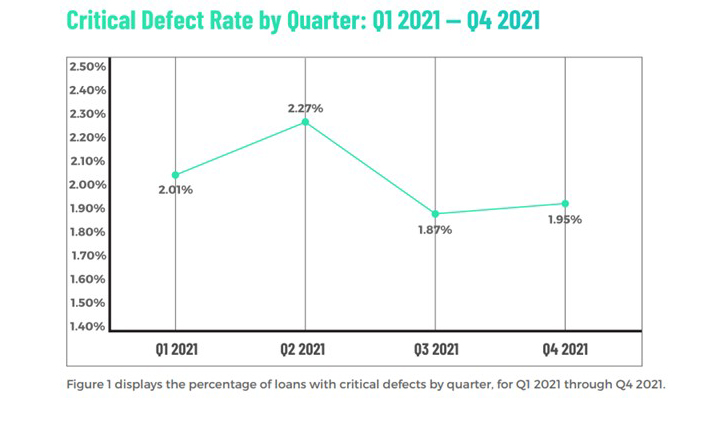

ACES: 4Q Critical Defect Rate Rises to 1.95%

ACES Quality Management, Denver, said overall critical defect rates increased in the fourth quarter.

The company’s Q4 Mortgage QC Industry Trends Report found the overall critical defect increased 0.08% to 1.95%, a change of 4% from the prior quarter, as lenders transitioned to a purchase-heavy lending environment.

Although Income/Employment defects declined in overall share, they remained the No. 1 most frequently cited issue, even after pandemic-related verification issues had subsided. Appraisal-related defects rose in the fourth quarter after experiencing minimal levels throughout the last refinance cycle. Purchase review share was 20 points higher than refinances, while the cConventional lending share is now 8 points below the pandemic peak amid a mini-resurgence in FHA lending.

“While the overall defect rate rose slightly in Q4 2021, defect rates have improved in totality when comparing 2021 to 2020,” said ACES Executive Vice President Nick Volpe. “Given the uptick in Q4 and the persistent issues we’re still seeing in the Income/Employment category, lenders should focus their efforts on shoring up this component of their underwriting process.”

All reviews and defect data evaluated for the report were based on loan audits selected by lenders for full file reviews.

“As lenders battle over volume, quality control and compliance teams are more important than ever to ensure that the loans that make it through the door meet all regulatory and eligibility requirements,” said ACES CEO Trevor Gauthier. “On the origination side, we’re seeing the credit box expand to help qualify more borrowers and maintain share. And with 1.3 million loans still in active forbearance along with the renewed focus on servicing from the CFPB and other regulators, servicers and lenders alike must be diligent in their compliance practices to survive this increased level of scrutiny.”

The report is available at https://www.acesquality.com/resources/reports.