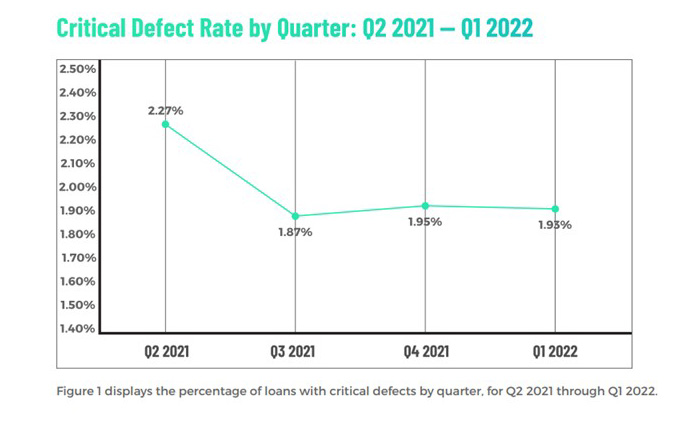

Critical Defect Rate Falls for 2nd Straight Quarter

ACES Quality Management, Denver, said the overall critical defect rate declined for the second straight quarter despite a more challenging mortgage lending environment.

The quarterly ACES Mortgage QC Industry Trends Report, covering the first quarter, said the overall critical defect ended the first quarter at 1.93%, an .02% decline from the fourth quarter. Other key findings:

● Defects in the Income/Employment category continue to remain high.

● The share of appraisal-related defects fell in Q1 2022 after rising in the prior quarter, but signs indicate lenders should pay special attention to this area going forward.

● Purchase and refinance shares remained unchanged from the prior quarter. Conventional loan share continued its multi-quarter trend of decline, with FHA loans filling the void and VA loan share also on the rebound.

● Purchase defects increased specifically I the FHA category, which is expected given purchase loans’ dominance in review share and the increase in FHA loans.

ACES Executive Vice President Nick Volpe said declining volumes have helped stabilize lender processes, keeping defects at bay, but signs are starting to emerge that the credit box is widening in the hunt for volume.

“Despite an overall decline in the critical defect rate for Q1 2022, the Income/Employment category remains a glaring problem,” Volpe said. “Lenders are finding this area a difficult one to rectify, and with staffing changes and new products coming online, it is more important than ever that QC managers get granular findings and feedback to their production group. Additionally, as lenders expand the credit box to win the fight for volume, they must be careful not to stretch too far and further exacerbate defects in this category.”

Volpe noted while the defect increases in three of the four core underwriting categories are cause for concern, “it was not all ‘doom and gloom’ for Q1 2022. Out of the 11 primary loan defect categories ACES tracks, five showed considerable improvement over last quarter, and none more so than the Documentation category, which dropped 37% from 14.57% to 9.09. This is a tangible example of the importance of quality control reporting. With quality control and quality assurance testing, lenders can course correct and improve the overall quality of their mortgage originations.”