ACES: Critical Defect Rate Down for Q1 2023

(Image courtesy ACES)

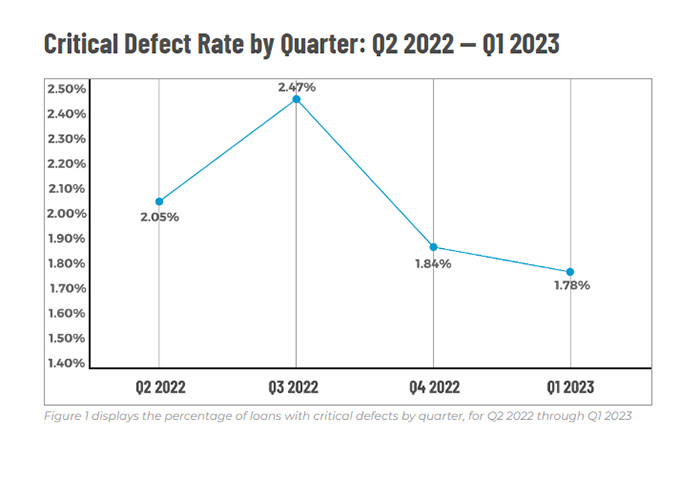

ACES Quality Management, Denver, reported the overall critical defect rate for the first quarter of 2023 was 1.78%. That’s down 3.26% from the previous quarter, and the second straight quarter of declines.

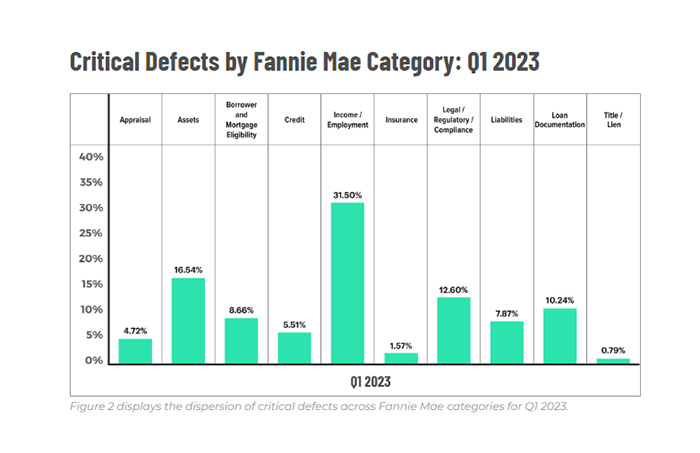

Of the major underwriting categories, the Income/Employment category continued to lead for the 13th consecutive quarter, with 31.5% of all defects. However, it saw a 14.66% decline from the previous quarter.

The Assets category also saw improvement, down 8.72% to 16.54% in the first quarter.

Credit defects were up 36.72% to 5.51%. And, the Liabilities category increased to 7.87% of all defects, up 17.29% from Q4.

Legal/Regulatory/Compliance defects were also up, as well as Insurance, given recent major weather events and the resulting fallout.

Loan Documentation increased slightly, and Appraisal defects increased by less than 1%.

Borrower/Mortgage Eligibility improved, decreasing by 38.54%.

“While the overall critical defect rate is trending in the right direction, there are several key areas of concern that will require lenders to remain vigilant to ensure defects continue heading southward, especially as the GSEs and agencies continue to increase their scrutiny of lenders’ production quality,” Nick Volpe, Executive Vice President of ACES Quality Management, said.

ACES pointed to the recent spate of high interest rates as influencing defects as “lenders didn’t have to combat rate volatility when qualifying borrowers.”

Additionally, the origination environment—which is down—put less strain on underwriting and processing teams, meaning quality issues were more likely to be caught.