ORLANDO—Despite another potentially economy-altering event this week—this time, the Russian invasion of Ukraine—Mortgage Bankers Association economists said the current picture for mortgage originators and servicers remains upbeat.

Tag: Marina Walsh CMB

MBA: Share of Mortgage Loans in Forbearance Drops to 1.30%

Loans in forbearance fell again in January to pre-pandemic lows, the Mortgage Bankers Association reported on Monday.

MBA: Share of Mortgage Loans in Forbearance Drops to 1.30%

Loans in forbearance fell again in January to pre-pandemic lows, the Mortgage Bankers Association reported on Monday.

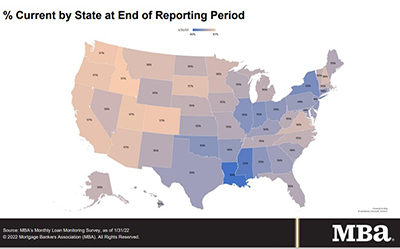

MBA Chart of the Week: Warehouse Lines for First Mortgages

The average usage level of first-mortgage warehouse lines – the percentage of outstanding borrowings to warehouse facility limits – fell for the sixth consecutive quarter to 38% as of the end of the fourth quarter, according to MBA’s quarterly Warehouse Lending Survey.

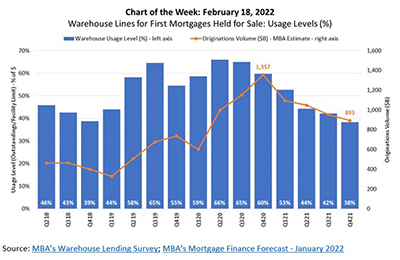

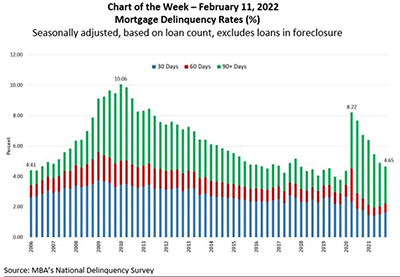

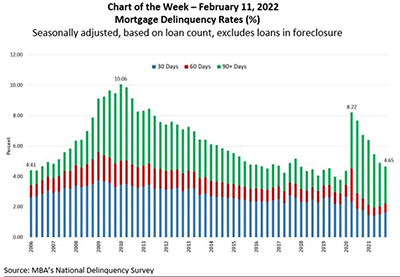

MBA Chart of the Week Feb. 14 2022: Mortgage Delinquency Rates

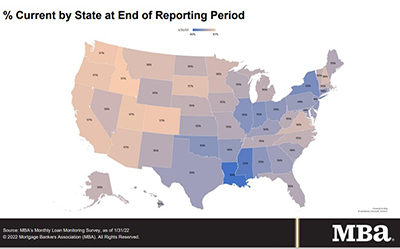

The Mortgage Bankers Association’s National Delinquency Survey – covering national and state delinquencies through the fourth quarter of 2021 – was released last week.

MBA Chart of the Week Feb. 14 2022: Mortgage Delinquency Rates

The Mortgage Bankers Association’s National Delinquency Survey – covering national and state delinquencies through the fourth quarter of 2021 – was released last week.

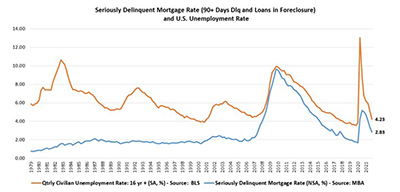

Mortgage Delinquencies Near Pre-Pandemic Lows

Delinquency rates for mortgage loans on one-to-four-unit residential properties continued to trend downward, nearing historic lows last seen before the coronavirus pandemic, the Mortgage Bankers Association reported Thursday.

Mortgage Delinquencies Near Pre-Pandemic Lows

Delinquency rates for mortgage loans on one-to-four-unit residential properties continued to trend downward, nearing historic lows last seen before the coronavirus pandemic, the Mortgage Bankers Association reported Thursday.

Mortgage Delinquencies Near Pre-Pandemic Lows

Delinquency rates for mortgage loans on one-to-four-unit residential properties continued to trend downward, nearing historic lows last seen before the coronavirus pandemic, the Mortgage Bankers Association reported Thursday.

A More Challenging Economic Environment for IMBs

NASHVILLE, Tenn.—The nation’s economy—and just as importantly, the housing market—are as challenging and as opportunistic in any time in history, according to Mortgage Bankers Association economists.