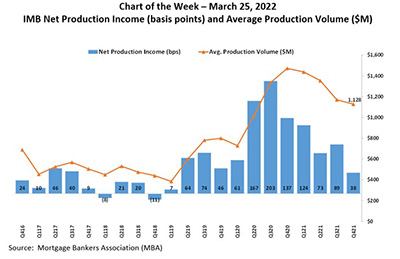

In this week’s MBA Chart of the Week, we show the average net production income from fourth-quarter 2016 through fourth-quarter 2021, along with the average production volume per company.

Tag: Marina Walsh CMB

MBA Chart of the Week Mar. 25 2022: IMB Net Production Income/Average Production Volume

In this week’s MBA Chart of the Week, we show the average net production income from fourth-quarter 2016 through fourth-quarter 2021, along with the average production volume per company.

MBA: IMB 4Q Production Profits Fall to 3-Year Low

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a net gain of $1,099 on each loan they originated in the fourth quarter, its lowest level in three years, the Mortgage Bankers Association reported Tuesday.

MBA: IMB 4Q Production Profits Fall to 3-Year Low

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a net gain of $1,099 on each loan they originated in the fourth quarter, its lowest level in three years, the Mortgage Bankers Association reported Tuesday.

MBA: IMB 4Q Production Profits Fall to 3-Year Low

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a net gain of $1,099 on each loan they originated in the fourth quarter, its lowest level in three years, the Mortgage Bankers Association reported Tuesday.

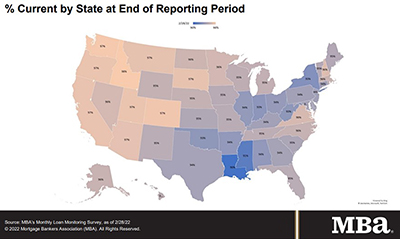

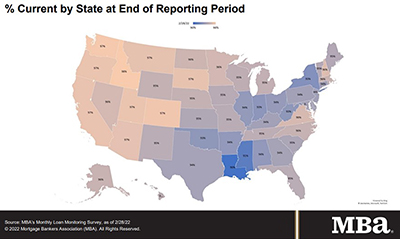

MBA: Share of Mortgage Loans in Forbearance Drops to 1.18%

The Mortgage Bankers Association’s monthly Loan Monitoring Survey reported loans now in forbearance decreased by 12 basis points to 1.18% of servicers’ portfolio volume as of Feb. 28 from 1.30% in January. MBA estimates 590,000 homeowners are in forbearance plans.

MBA: Share of Mortgage Loans in Forbearance Drops to 1.18%

The Mortgage Bankers Association’s monthly Loan Monitoring Survey reported loans now in forbearance decreased by 12 basis points to 1.18% of servicers’ portfolio volume as of Feb. 28 from 1.30% in January. MBA estimates 590,000 homeowners are in forbearance plans.

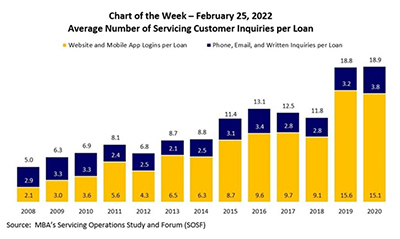

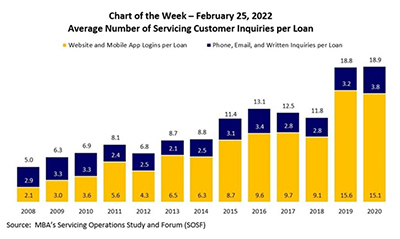

MBA Chart of the Week: Servicing Customer Inquiries Per Loan

In this week’s MBA Chart of the Week, we focus on borrower communications, specifically the average number of annual servicing customer inquiries per loan. MBA has tracked this data through its Servicing Operations Study and Forum since 2008.

MBA Chart of the Week: Servicing Customer Inquiries Per Loan

In this week’s MBA Chart of the Week, we focus on borrower communications, specifically the average number of annual servicing customer inquiries per loan. MBA has tracked this data through its Servicing Operations Study and Forum since 2008.

MBA Economists: Outlook Strong for Originations, Servicing

ORLANDO—Despite another potentially economy-altering event this week—this time, the Russian invasion of Ukraine—Mortgage Bankers Association economists said the current picture for mortgage originators and servicers remains upbeat.