Mortgage Delinquencies Near Pre-Pandemic Lows

Delinquency rates for mortgage loans on one-to-four-unit residential properties continued to trend downward, nearing historic lows last seen before the coronavirus pandemic, the Mortgage Bankers Association reported Thursday.

The MBA 4th Quarter National Delinquency Survey reported the overall delinquency rate for fell to a seasonally adjusted rate of 4.65 percent of all loans outstanding, down 23 basis points from the third quarter of 2021 and down 208 basis points from one year ago.

Additionally, MBA reported the foreclosure inventory rate fell to its lowest level since 1981.

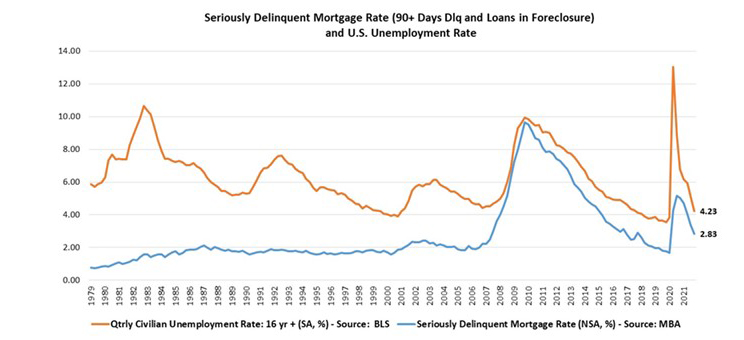

MBA Vice President of Industry Analysis Marina Walsh, CMB, noted delinquency levels fell at or below MBA survey averages dating back to 1979. The fourth-quarter delinquency rate of 4.65 percent was 67 basis points lower than MBA’s survey average of 5.32 percent; the seriously delinquent rate, the percentage of loans 90 days or more past due or in the process of foreclosure, was 2.83 percent in the fourth quarter, close to the long-term average of 2.80 percent

“The quarters right before the COVID-19 pandemic represented some of the lowest delinquencies ever recorded; delinquencies are now approaching levels not seen since the first quarter of 2020, which is a testament to the strength of the U.S. labor market,” Walsh said. She noted economic forces have prevailed, including low unemployment, more labor force participation, higher wage growth and accumulated home equity – as well as support for homeowners through post-forbearance loan workouts.

“Potential negative effects of the omicron variant were also muted this past quarter,” Walsh said.

Other key findings of the MBA Fourth Quarter of 2021 National Delinquency Survey:

• From the third quarter, the seasonally adjusted mortgage delinquency rate decreased for all loans outstanding. By stage, the 30-day delinquency rate increased 14 basis points to 1.65 percent, the 60-day delinquency rate increased 4 basis points to 0.56 percent, and the 90-day delinquency bucket decreased 41 basis points to 2.44 percent.

• By loan type, the total delinquency rate for conventional loans increased 3 basis points to 3.58 percent over the previous quarter. The FHA delinquency rate decreased 58 basis points to 10.76 percent, while the VA delinquency rate decreased by 57 basis points to 5.24 percent.

• On a year-over-year basis, total mortgage delinquencies decreased for all loans outstanding. The delinquency rate decreased by 151 basis points for conventional loans, decreased 389 basis points for FHA loans and decreased 205 basis points for VA loans.

• The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the fourth quarter was 0.42 percent, down 4 basis points from the third quarter of 2021 and 14 basis points lower than one year ago. This is the lowest foreclosure inventory rate since third quarter of 1981. The percentage of loans on which foreclosure actions were started in the fourth quarter rose by 1 basis point to 0.04 percent, up from the survey low seen in third-quarter 2021 at 0.03 percent.

• The non-seasonally adjusted seriously delinquent rate—the percentage of loans that are 90 days or more past due or in the process of foreclosure—fell to 2.83 percent. It decreased by 57 basis points from last quarter and decreased by 220 basis points from last year. The seriously delinquent rate decreased 33 basis points for conventional loans, decreased 171 basis points for FHA loans and decreased 66 basis points for VA loans from the previous quarter. From a year ago, the seriously delinquent rate decreased by 163 basis points for conventional loans, decreased 471 basis points for FHA loans and decreased 214 basis points for VA loans.

• States with the largest quarterly decreases in their overall delinquency rate were: Louisiana (119 basis points), Nevada (80 basis points), Alaska (72 basis points), and Texas (66 basis points).

Note: An estimated 705,000 homeowners were on forbearance plans as of December 31, 2021. As previously stated, for the purposes of this survey, MBA asks servicers to report the loans in forbearance as delinquent if the payment was not made based on the original terms of the mortgage.

The NDS covers more than 39 million loans on one- to four- unit residential properties. Loans surveyed were reported by nearly 90 lenders, including independent mortgage companies, and depositories such as large banks, community banks and credit unions.