CoreLogic, Irvine, Calif., reported a 26.3% year-over-year decrease in fraud risk at the end of the second quarter, the second year of substantial decreases in risk.

Tag: Coronavirus

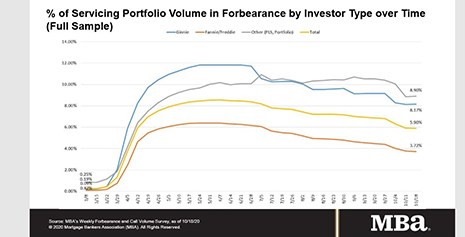

MBA: Share of Mortgage Loans in Forbearance Dips Slightly to 5.90%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 2 basis points to 5.90% of servicers’ portfolio volume as of Oct. 18, from 5.92% the prior week. MBA estimates 3 million homeowners are in forbearance plans.

‘Ghosting’ and ‘Not OK? That’s OK:’ Servicing During a Pandemic

The COVID-19 pandemic has hit borrowers hard. But mortgage servicers are eager to help.

Carson: FHA Will Extend Forbearance Requests Through Year-End

HUD Secretary Ben Carson announced the Federal Housing Administration will extend the date for single-family homeowners with FHA-insured mortgages to request an initial forbearance from their mortgage servicer for up to six months.

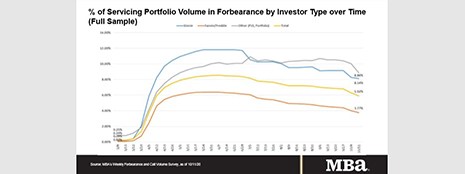

MBA: Share of Mortgage Loans in Forbearance Falls to 5.92%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 40 basis points to 5.92% of servicers’ portfolio volume as of October 11, from 6.32% the prior week. MBA now estimates 3 million homeowners are in forbearance plans.

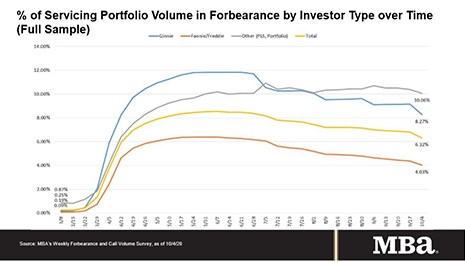

MBA: Share of Mortgage Loans in Forbearance Drops to 6.32%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 49 basis points to 6.32% of servicers’ portfolio volume in the prior week as of October 4 from 6.81% the previous week. MBA estimates 3.2 million homeowners are in forbearance plans.

The World is Changing: is Real Estate Ready?

It’s safe to say 2020 has been one “hold my beer” moment after another. And the real estate finance industry, says States Title, San Francisco, had better be prepared for more changes—or risk obsolescence.

ATTOM: Northeast Housing Markets at Highest Risk of Pandemic Economic Impact

ATTOM Data Solutions, Irvine, Calif., said its third-quarter Special Report shows pockets of the Northeast and Mid-Atlantic regions most at risk, with clusters in the New York City, Baltimore, Philadelphia and Washington, D.C. areas – while the West and now Midwest are less vulnerable.

Fitch: Remote Working to Affect Housing Demand—But Not U.S. RMBS Ratings

Fitch Ratings, New York, said while remote working in the U.S. accelerated as a result of the coronavirus pandemic, and is reducing the importance of proximity to offices and causing migration from urban to suburban and exurban areas, it does not expect any material effect on the credit quality of its rated U.S. residential mortgage-backed securities pools.

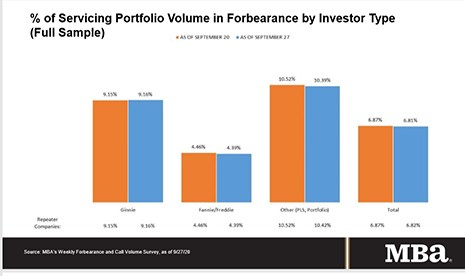

MBA: Share of Loans in Forbearance Falls to 6.81%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 6 basis points to 6.81% of servicers’ portfolio volume as of Sept. 27, from 6.87% the prior week. MBA now estimates 3.4 million homeowners are in forbearance plans.