Carson: FHA Will Extend Forbearance Requests Through Year-End

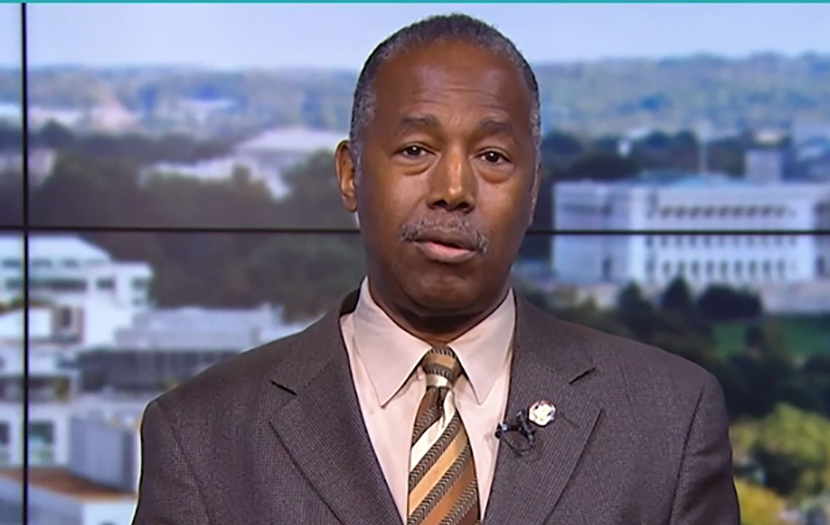

(HUD Secretary Ben Carson.)

HUD Secretary Ben Carson announced the Federal Housing Administration will extend the date for single-family homeowners with FHA-insured mortgages to request an initial forbearance from their mortgage servicer for up to six months.

“Homeownership is the largest wealth-builder for the majority of our nation’s families, which is why one of our top priorities is providing relief from foreclosure and eviction due to circumstances beyond [homeowners’] control,” Carson said at the Mortgage Bankers Association’s virtual Annual Convention & Expo. “This will ensure that homeowners have the resources and support they need to get back on their feet as our country continues its economic recovery.”

Homeowners experiencing a financial hardship due to the pandemic may now request an initial forbearance through December 31, 2020. Previously, homeowners with FHA-insured mortgages needing assistance had until October 30 to request a COVID-19 forbearance from their mortgage servicer.

“I can’t stress enough that this relief should be reserved for those that need it most,” Carson said. “Americans who are capable of paying their mortgage on time should do so.”

Carson said HUD is managing risk to taxpayers of any losses due to COVID-19. “FHA has been steadily building capital, which put us in a strong position going into this period of uncertainty,” he said. He noted FHA’s Mutual Mortgage Insurance capital ratio was 4.84 percent at the end of fiscal year 2019 compared to 2.18 percent in 2017. “A stronger FHA supports a healthier and more stable housing market for low-to moderate-income homeowners,” he said.

Another cause for optimism is that purchases of new homes continue at a strong pace, Carson noted. “Year-over-year home price increases have also accelerated and interest rates remain at all-time lows,” he said. “As we continue forward, we are confident that our current capital position along with a strong housing market will help FHA to better withstand the economic stresses brought on by the pandemic.”

In a statement, HUD Deputy Assistant Secretary for Single-Family Housing Joe Gormley said homeowners who are struggling should engage with their servicer immediately. “And, if your servicer contacts you, it is crucial that you respond to them to let them know if you need assistance,” he said. “The last thing FHA wants is for any homeowner to risk losing their homeownership investment if they are eligible for assistance.”

FHA requires mortgage servicers to:

–Offer homeowners with FHA-insured mortgages mortgage payment forbearance when the homeowner requests it, with the option to extend the forbearance for up to a year in total. FHA does not require a lump-sum payment at the end of the forbearance period.

–Assess homeowners who receive COVID-19 forbearance for its special COVID-19 National Emergency Standalone Partial Claim before the end of the forbearance period. The COVID-19 National Emergency Standalone Partial Claim puts all suspended mortgage payment amounts owed into a junior lien, which is only repaid when the homeowner sells the home, refinances the mortgage, or the mortgage is otherwise extinguished.

–Assess homeowners who are not eligible for the COVID-19 National Emergency Standalone Partial Claim for one of FHA’s COVID-19 expanded home retention solutions announced on July 8.