MBA: Share of Mortgage Loans in Forbearance Drops to 6.32%

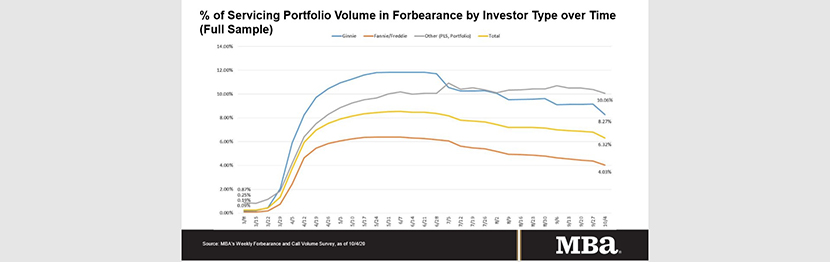

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 49 basis points to 6.32% of servicers’ portfolio volume in the prior week as of October 4 from 6.81% the previous week. MBA estimates 3.2 million homeowners are in forbearance plans.

The share of Fannie Mae and Freddie Mac loans in forbearance dropped for the 18th week in a row to 4.03% – a 36-basis-point improvement. Ginnie Mae loans in forbearance decreased 89 basis points to 8.27%, while the forbearance share for portfolio loans and private-label securities decreased by 33 basis points to 10.06%. The percentage of loans in forbearance for depository servicers decreased 50 basis points to 6.53%, and the percentage of loans in forbearance for independent mortgage bank servicers decreased 54 basis points to 6.65%.

“With the forbearance program for federally backed loans under the CARES Act reaching the six-month mark, many borrowers saw their forbearance plans expire because they did not contact their servicer,” said Mike Fratantoni, MBA Senior Vice President and Chief Economist. “Another reason for expirations was that borrower information needed to determine an appropriate loss mitigation option was not yet in place,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “Borrowers with federally backed mortgages need to contact their servicer to obtain another six months of reprieve if they are still impacted by the pandemic. As of now, some borrowers are exiting forbearance without making contact or without a plan in place. Servicers are making outreach efforts to attempt to work with these borrowers to determine the best options for them, including an extension.”

On a more positive note, Fratantoni said, nearly two-thirds of borrowers who exited forbearance remained current on their payments, repaid their forborne payments, or moved into a payment deferral plan. “All of these borrowers have been able to resume – or continue – their pre-pandemic monthly payments,” he said.

Key findings of MBA’s Forbearance and Call Volume Survey – September 28-October 4:

- Total loans in forbearance decreased by 49 basis points relative to the prior week: from 6.81% to 6.32%.

- By investor type, the share of Ginnie Mae loans in forbearance decreased relative to the prior week: from 9.16% to 8.27%.

- The share of Fannie Mae and Freddie Mac loans in forbearance decreased relative to the prior week: from 4.39% to 4.03%.

- The share of other loans (e.g., portfolio and PLS loans) in forbearance decreased relative to the prior week: from 10.39% to 10.06%.

- By stage, 25.50% of total loans in forbearance are in the initial forbearance plan stage, while 72.97% are in a forbearance extension. The remaining 1.53% are forbearance re-entries.

- Total weekly forbearance requests as a percent of servicing portfolio volume (#) increased relative to the prior week: from 0.08% to 0.11%.

- Weekly servicer call center volume:

- As a percent of servicing portfolio volume (#), calls increased from 6.8% to 8.8%.

- Average speed to answer increased from 2.3 minutes to 2.9 minutes.

- Abandonment rates increased from 5.3% to 6.7%.

- Average call length increased from 7.6 minutes to 7.8 minutes.

- Loans in forbearance as a share of servicing portfolio volume (#) as of October 4:

- Total: 6.32% (previous week: 6.81%)

- IMBs: 6.65% (previous week: 7.19%)

- Depositories: 6.53% (previous week: 7.03%)

MBA’s latest Forbearance and Call Volume Survey represents 74% of the first-mortgage servicing market (36.8 million loans).

To subscribe to the full report, go to www.mba.org/fbsurvey. If you are a mortgage servicer interested in participating in the survey, email fbsurvey@mba.org.