‘Ghosting’ and ‘Not OK? That’s OK:’ Servicing During a Pandemic

(Clockwise from top left: Candace Russell, Dana Dillard, John Courtney, Chris Brinkley)

The COVID-19 pandemic has hit borrowers hard. But mortgage servicers are eager to help.

“I think we’re all surprised by customers who have not raised their hand for help because from our perspective it’s very easy. There’s a low barrier to entry,” said Dana Dillard, Executive Vice President of Corporate and Social Responsibility with Mr. Cooper, Dallas, at the recent MBA Annual Convention & Expo. “Most customers can just go to their servicer’s website and get some immediate relief.”

Dillard acknowledged that borrowers have a lot on their plates at the moment. “Maybe they have unemployment issues, kids, schooling, health issues and in some cases that are really rough, maybe they’re facing fires, floods and hurricanes,” she said. “So it’s hard to get their attention.”

But it’s worth the effort to get the attention of stressed borrowers, Dillard said. “One customer who had not been replying to his servicer’s outreach came to a recent virtual outreach event,” she reported. “He said, ‘I know y’all have been trying to get ahold of me. I’ve been ignoring you because I just don’t have any money to do anything with.’ We were able to give him a forbearance right on the spot and the non-profit organization that we work with had access to funds to help him with groceries and electric bills immediately. They wired funds to a debit card while we were sitting there. So, the help is easy to get, but to customers it can feel overwhelming sometimes. I think that’s the main reason they might ‘ghost’ a mortgage servicer.”

Chris Brinkley, Senior Vice President of First American Mortgage Solutions’ post-closing and servicing division, Santa Ana, Calif., said ghosting was “puzzling.”

“Are borrowers purposely opting out of the conversation, or is it more of a communication challenge?” Brinkley asked. “Are they afraid? Do they have other things going on in their lives–which we all do at this point? Maybe they are unaware of their options?”

John Courtney, CEO of Outplacement services firm NextJob, Bend, Ore., noted unemployment is difficult for borrowers. “The unemployed person is normally getting pretty depressed by the time they stop paying [their mortgage],” he said. “A lot of borrowers we run into say, ‘I need a job; I don’t know what banks can do for me’.”

Courtney said the so-called ‘K-shaped’ recovery in which some parts of the economy are recovering while others are still trending downward might be a factor. “We know among the industries most affected by the pandemic are hotels, travel, restaurants and retail,” he said. “In those industries there might be more lower-income workers. We find for those who are lower income, their duration of unemployment tends to be longer. So what happens is people get a little more dejected.”

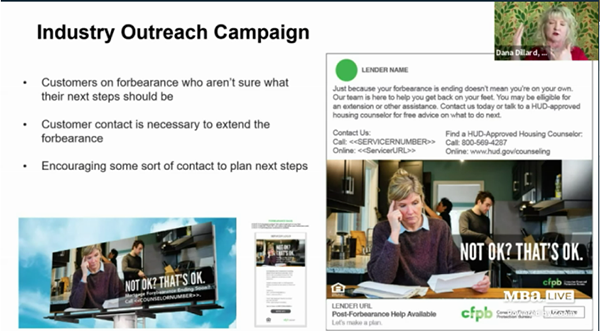

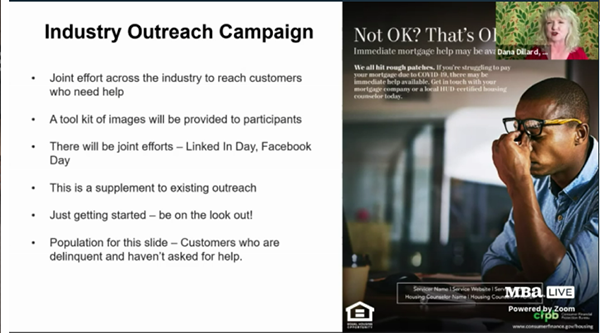

Dillard reported mortgage industry groups including the Mortgage Bankers Association, the American Bankers Association and several non-profit organizations have joined forces and are creating an outreach campaign to contact and reassure distressed customers.

“It is aimed at two groups of customers,” Dillard said. “First, the group that is delinquent but has not raised their hands to ask for help. And there will be a second ad for a second population, people in forbearance who don’t know what their options are. The campaign’s theme is ‘Not OK? That’s OK. We have tools to help you.’,” she said.

Dillard encouraged mortgage servicers and others in the mortgage space to explore the ad campaign. “We hope you’ll join us and try to create an ‘echo chamber’ of help,” she said. “So customers will know that if they need help they can get help and they won’t need to bring money to the table. They can raise their hand and we’ll pull out all the tools that are available to them. We’re hoping this will reach a hard-to-reach audience.”

Tags: