MBA: Share of Mortgage Loans in Forbearance Falls to 5.92%

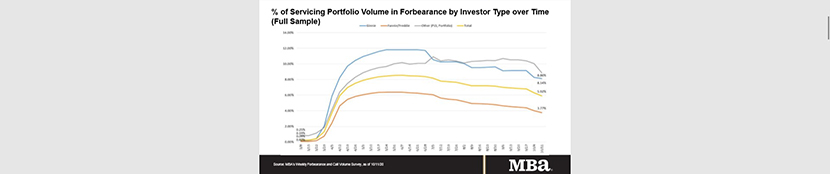

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 40 basis points to 5.92% of servicers’ portfolio volume as of October 11, from 6.32% the prior week. MBA now estimates 3 million homeowners are in forbearance plans.

The share of Fannie Mae and Freddie Mac loans in forbearance dropped for the 19th week in a row to 3.77% – a 26-basis-point improvement. Ginnie Mae loans in forbearance decreased 13 basis points to 8.14%, while the forbearance share for portfolio loans and private-label securities decreased by 120 basis points to 8.86%. The percentage of loans in forbearance for depository servicers decreased 60 basis points to 5.93%, and the percentage of loans in forbearance for independent mortgage bank servicers decreased 32 basis points to 6.33%.

“The share of loans in forbearance declined across all loan types, primarily because of borrower forbearance plans expiring at the six-month mark. Federally backed loans under the CARES Act are eligible to be extended for up to 12 months, but borrowers must contact their servicer for an extension. Without that contact, borrowers exit forbearance, whether they are delinquent or current on their loan,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “Borrowers with federally backed mortgages should contact their servicer if they still have a hardship due to the pandemic.”

Fratantoni noted the steady improvement for Fannie Mae and Freddie Mac loans highlights improvement in some segments of the job market and broader economy. “The slower decline for Ginnie Mae loans continues to show that this improvement has not been uniform, and that many are still struggling to regain their footing,” he said.

Key findings of MBA’s Forbearance and Call Volume Survey – October 5-11:

- Total loans in forbearance decreased by 40 basis points relative to the prior week: from 6.32% to 5.92%.

- By investor type, the share of Ginnie Mae loans in forbearance decreased relative to the prior week: from 8.27% to 8.14%.

- The share of Fannie Mae and Freddie Mac loans in forbearance decreased relative to the prior week: from 4.03% to 3.77%.

- The share of other loans (e.g., portfolio and PLS loans) in forbearance decreased relative to the prior week: from 10.06% to 8.86%.

- By stage, 26.32% of total loans in forbearance are in the initial forbearance plan stage, while 72.08% are in a forbearance extension. The remaining 1.60% are forbearance re-entries.

- Total weekly forbearance requests as a percent of servicing portfolio volume (#) decreased relative to the prior week: from 0.11% to 0.10%.

- Weekly servicer call center volume:

- As a percent of servicing portfolio volume (#), calls decreased from 8.8% to 8.2%.

- Average speed to answer increased from 2.9 minutes to 3.0 minutes.

- Abandonment rates increased from 6.7% to 7.0%.

- Average call length decreased from 7.8 minutes to 7.6 minutes.

- Loans in forbearance as a share of servicing portfolio volume (#) as of October 11:

- Total: 5.92% (previous week: 6.32%)

- IMBs: 6.33% (previous week: 6.65%)

- Depositories: 5.93% (previous week: 6.53%)

MBA’s latest Forbearance and Call Volume Survey represents 75% of the first-mortgage servicing market (37.3 million loans).

To subscribe to the full report, go to www.mba.org/fbsurvey. If you are a mortgage servicer interested in participating in the survey, email fbsurvey@mba.org.