Data on 2022 county-level population changes continue to suggest that the coronavirus pandemic had profound and lasting impacts on economic geography—with two million people leaving U.S. cities—according to a report by the Economic Innovation Group, Washington, D.C.

Tag: Coronavirus

FHA Expands Mortgage Eligibility for Borrowers Previously Affected by COVID-19

The Federal Housing Administration on Thursday expanded mortgage eligibility for borrowers who experienced a gap in employment and/or a reduction or loss of income due to a COVID-19 related economic event.

Servicing22: How the Pandemic Made Government Loan Programs More Nimble

ORLANDO—Perhaps the most innovative adaption in the real estate finance industry during the coronavirus pandemic came not from the mortgage industry itself, but from the historically least agile sector—government loan programs.

Freddie Mac: Single Women Have Low Confidence in Homeownership Prospects

Freddie Mac, McLean, Va., reported nearly 60 percent of single female head-of-household renters feel homeownership is out of reach indefinitely.

RMQA21: Pandemic Saw Changes in Consumer Behavior—Most of it Good

WASHINGTON, D.C.—The economy continued to improve in 2021, fueled by record consumer savings and strong gains in employment, despite the coronavirus pandemic that could have otherwise ground it to a halt, said Emre Sahingur, Senior Vice President of Predictive Analytics with VantageScore Solutions LLC, Stamford, Conn.

FHA Adds COVID-19 Forbearance Relief Options

The Federal Housing Administration on Sept. 27 announced new and extended COVID-19 relief options for borrowers recently or newly struggling to make their mortgage payments because of the pandemic and for senior homeowners with Home Equity Conversion Mortgages who need assistance to remain in their homes.

Real Estate Investment Trusts Poised For Recovery

S&P Global Ratings, New York, said real estate investment trust earnings rebounded significantly in the second quarter, demonstrating the sector is on the right path for a solid comeback.

Fewer Than 1 in 5 With Pre-Pandemic Mortgages Have Refinanced

Despite record low interest rates, just 19 percent of homeowners with a mortgage they had prior to the pandemic have refinanced since COVID-19 started, according to Bankrate.com.

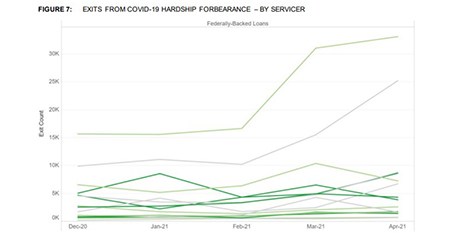

CFPB: Mortgage Servicers’ Pandemic Response Varies Significantly

The Consumer Financial Protection Bureau on Tuesday published a report detailing 16 large mortgage servicers’ COVID-19 pandemic response. The report showed a disparate response in call metrics, exit metrics and other measures.

Murali Tirupati: How Mortgage Servicers Can Improve Operations with an ‘Automation-First’ Strategy

mortgage servicers are under tremendous pressure to not just onboard loan files faster but do so in compliance with regulatory requirements of CFPB.