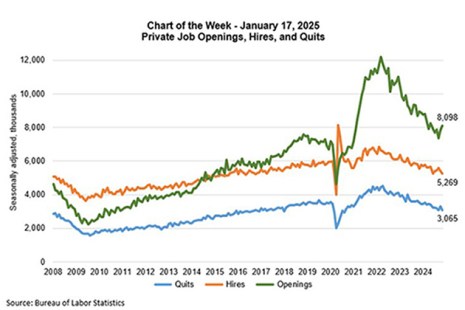

As we highlighted in a previous Chart of the Week, the share of workers who were unemployed for longer spells has increased, implying that even though the job market is generally strong, it has been harder for those workers who have lost jobs to regain employment.

Tag: MBA Chart of the Week

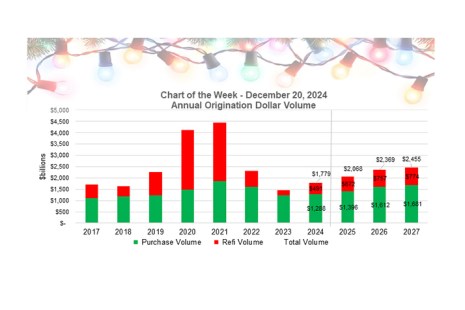

MBA Chart of the Week: Annual Origination Dollar Volume

At its December meeting, the FOMC cut their rate target by another 25 basis points as the market had anticipated.

Chart of the Week: Unemployment by Duration

Fed officials have pointed to their “data dependence” regarding decisions about future rate cuts. These November employment data support a cut at the December meeting and MBA forecasts that the Fed will continue to reduce short-term rates in 2025, although they are likely to slow the pace of cuts.

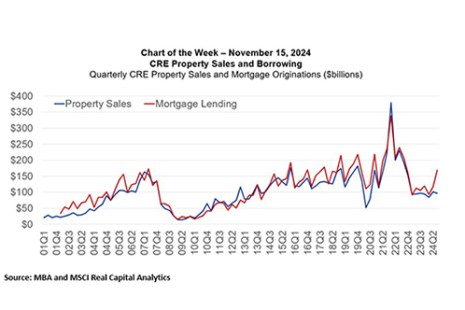

Chart of the Week: CRE Property Sales and Borrowing

After a slow start to this year, borrowing and lending backed by commercial real estate properties picked up during the third quarter. Originations increased 59 percent compared to a year ago and increased 44 percent from the second quarter of 2024.

Chart of the Week: 10-Year Treasury and 30-Year Fixed Mortgage Rates

Both Treasury yields and mortgage rates declined from April to September 2024 in anticipation of the Federal Reserve’s first rate cut, influenced by the cooling job market and inflation moving towards the Fed’s 2 percent goal.

Chart of the Week: Purchase Applications Payment Index for Selected States

As attendees from this year’s Annual Convention and Expo returned to their respective states, many messages are top of mind. One priority is supply and affordability.

MBA Chart of the Week: Homeownership Rates

The Census Bureau recently released its 2023 American Community Survey one-year estimates.

MBA Chart of the Week: Share of Originations by Production Channel

The broker wholesale and non-delegated correspondent production channels accounted for a combined 20.5 percent of dollar volume originated in 2023 per MBA’s analyses of the Home Mortgage Disclosure Act (HMDA) data.

Chart of the Week: Payroll Growth and Unemployment Rate

The August employment report confirmed that the job market is cooling.

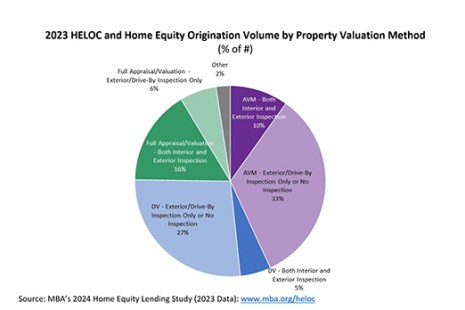

Chart of the Week: 2023 HELOC and Home Equity Origination Volume by Valuation Method

MBA recently completed its 2024 Home Equity Lending Study (covering 2023 data) tracking trends in origination and servicing operations for home equity lines of credit and home equity loans.