MBA Chart of the Week: Mortgage Payment to Rent Ratio

MBA recently released its March Purchase Applications Payment Index data which revealed that homebuyer affordability took another hit in March with the typical homebuyer’s monthly payment eclipsing $2,200 for the first time in the series. Median principal and interest payments were 5.2% higher than in March 2023, and despite relatively strong usual weekly earnings growth of 3.5%, the median PAPI index (that controls for income growth) was up 1.6% year-on-year—further reducing the purchasing power of potential homebuyers. This week’s MBA Weekly Mortgage Applications Survey data also revealed that interest rates hit a 5-month high at 7.29% and as home prices continue to climb, relief may be delayed until later in the year.

While homebuyer affordability is challenging, increases in rents have slowed. According to U.S. Census Bureau Housing Vacancy Survey (HVS) data released on Tuesday, median asking rents increased from $1,465 in the fourth quarter of 2023 to $1,469 in the first quarter of 2024. Indeed, HVS nominal median asking rents are up only 0.5% from the first quarter of 2023.

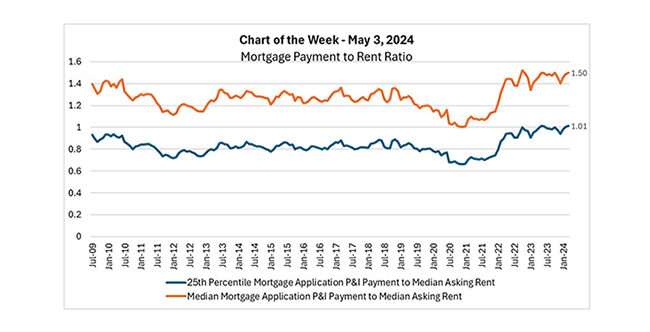

This week’s MBA Chart of the Week examines the mortgage payment to rent ratio (MPRR) using WAS mortgage and HVS rent data. The orange line relates the median principal and interest payment to the median asking rent, and the blue line relates the 25th percentile mortgage application payment to the median asking rent (that may be a more suitable ratio for first-time homebuyers).

The median P&I to median asking rent ratio was 1.50 in March, towards the upper end of the band since mortgage rates doubled in 2022. In the seven years prior to the pandemic, the orange series moved around 1.27. In other words, despite reported rent increases during the pandemic, the doubling in mortgage rates and continued house price appreciation kept typical mortgage payments relatively more expensive. Moreover, at the 25th percentile for monthly mortgage payments, the ratio is above 1.00, compared to an average of 0.83 in the seven years before the pandemic.

Given recent economic data, the Fed appears to be in no hurry to change its stance on monetary policy. Our latest forecast expects mortgage rates to decline to 6.4% this year—neither as far nor as fast as we previously had predicted. Meanwhile, with multifamily completions expected to remain high, which would ease rents further, it is plausible that the mortgage payment to rent ratio may further increase going forward.

Edward Seiler (eseiler@mba.org)