MBA Chart of the Week: Payroll Growth and Unemployment

Source: Bureau of Labor Statistics

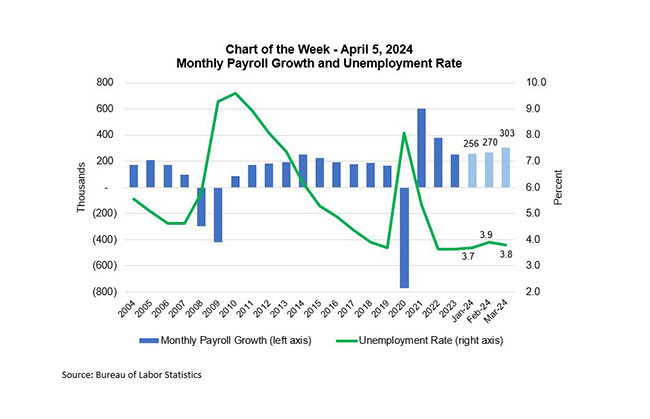

Our Chart of the Week focuses on Friday’s Employment Situation report released by the Bureau of Labor Statistics.

The release showed that the job market is still quite strong, with employment gains at 303,000 for March, well above what would be expected at this point in the cycle. This was higher than the previous month’s increase of 270,000 jobs, and the prior two months’ job gains were revised up by 22,000 jobs in total. Although the gains remain concentrated in sectors like health care, government, and leisure and hospitality, there was also a pickup in construction hires, a positive for the housing market given the lack of supply. The construction sector added 39,000 jobs in March, the largest single-month increase since May 2022. Specialty trade contractors accounted for 25,200 of those jobs, with both residential and nonresidential contractors seeing new jobs added over the month.

The diffusion index, a measure of the breadth of job gains across the economy, was 59.4%. This meant that 59.4% of industries either added jobs or were unchanged from the previous month, and this was close to the 12-month average of 59.1%.

Wages increased at a 4.1% rate over the past year, down a bit from earlier this year, but still a more rapid pace than is likely to be maintained over the course of this year. According to the JOLTS data from the BLS, there were 8.8 million job openings in February, down from a peak of 12.2 million in 2022 but still, around double the 2001 to 2019 average, indicating that there is still strong labor demand from employers in some sectors of the economy.

Unemployment declined very slightly to 3.8%, helped by stronger reported employment growth in the household survey. Labor force participation stayed within the narrow range of the past year at 62.7%. Our view is that recent data continues to point to a slowdown in economic growth in 2024, but the odds of a recession are much reduced given the resilient job market, which will support consumer spending. This report will bolster the case for the FOMC to hold off on any rate cuts in the near term, keeping mortgage rates elevated for now.