MBA Chart of the Week: Climate, Sustainability and Real Estate Finance

With Earth Day happening this month, it seems an opportune time to discuss the intersection of climate/sustainability issues and real estate finance. MBA has been leading on these issues for more than half a decade, helping members through our work related to research, policy and practice.

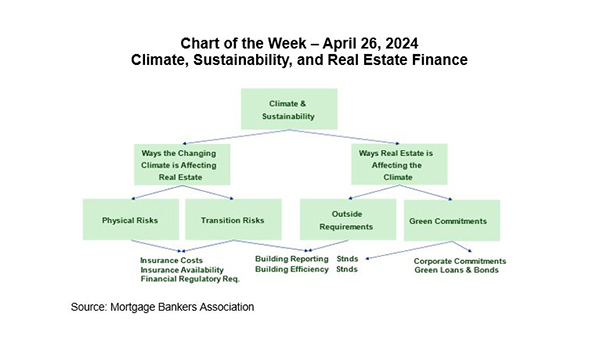

There are two central issues related to climate change and real estate finance: a) how a changing climate is affecting real estate and b) how real estate is affecting the climate.

Regarding how the changing climate is affecting real estate, MBA and its Research Institute for Housing America (RIHA) have been providing industry-leading research on the topic. RIHA has published papers including The Impact of Climate Change on Housing and Housing Finance, A Collection of Essays on Climate Risk and the Housing Market: Volume I, A Collection of Essays on Climate Risk and the Housing Market: Volume 2. MBA’s Research & Economics team contributed its own Who Owns Climate Risk in the U.S. Real Estate Market?

A key takeaway from all these reports is that the current system does a remarkably effective job of assessing, mitigating, and pricing physical climate risk (relying heavily on insurance markets to do so) but that the short-term insurance policies used to address long-term trends mean that transition risks pose a unique challenge. Increasingly, we are also hearing and seeing that new reporting and efficiency standards, particularly at the local level, as well as financial regulatory requirements, have the potential to raise new transition risks that could significantly impact property operations, values and viability.

On how real estate is affecting the climate, given that we spend most of our waking (and sleeping) hours in real estate, it is not surprising that much of the greenhouse gas (GHG) emissions related to our energy use funnel through real estate; not just heating and cooling but also lighting, cooking, computer use, car charging, and more. Efforts to reduce those emissions come in two forms: a) green commitments and b) outside requirements.

Many actors in this space have made corporate commitments to reduce emissions – whether Scope 1, 2, or 3. There is a range of standards available for property owners and others to measure their activities. In August 2022, MISMO, the real estate finance industry’s standards-setting body, released a Green Borrower Questionnaire developed by a group of commercial real estate lenders who agreed to use a common set of questions to ask their borrowers about their Green bona fides.

But much of that early focus on green commitments has now been overshadowed by a focus on managing changing outside requirements from regulators and others, which has become a transition risk of its own. Proposals from the SEC and California have focused on reporting GHG emissions, while laws like Local Law 97 in New York have imposed local building efficiency standards. The impact these requirements will have on lenders is just beginning to be understood.

We’re likely to hear more rather than less about the intersection of climate change and real estate in coming years. MBA will continue to work with our members – through research, policy, and practice – to make that intersection as efficient and effective as possible. Mike Fratantoni (mfratantoni@mba.org), Eddie Seiler (eseiler@mba.org), Jamie Woodwell (jwoodwell@mba.org)