MBA Chart of the Week: Builder Applications Index Vs. Weekly Purchase Applications Index

As we enter the spring home-buying season, existing-home sales activity remains suppressed by low levels of for-sale inventory. Available supply sits at just over one million units – a 2.9-month supply – and about half the historical average, based on data from the National Association of Realtors. Many homeowners are holding onto mortgage rates significantly lower than currently available rates, which is discouraging them from listing their homes for sale. This is adding to the drag on overall purchase activity, even with buyers willing to purchase in the current rate environment.

Sales of newly built homes on the other hand continue to be strong. U.S. Census Bureau data show that the inventory of new homes for sale at 463,000 units as of February 2024 – an 8.4-month supply – now represents over 30 percent of all single-family units for sale. Home buyers have turned to new homes as an option if previously owned homes are not available or in their price range, not only because of the relative availability of new homes but also because of the prospect of a newer, higher quality home. This is especially the case given the tradeoff of a higher mortgage rate.

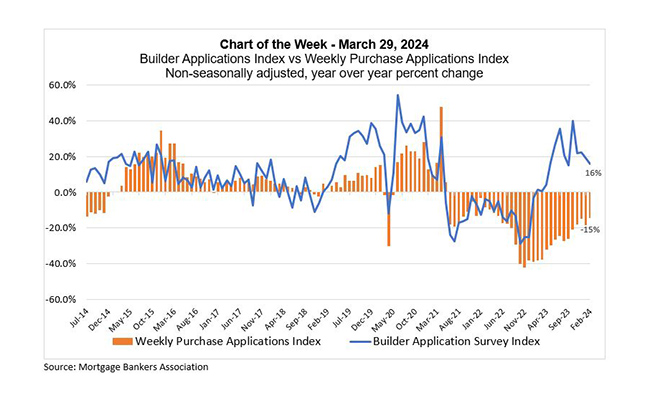

This week’s Chart of the Week compares data from our Builder Applications Survey (BAS), which captures home purchase applications on newly constructed homes taken by mortgage companies affiliated with home builders, and the Weekly Applications Survey (WAS), which covers a broader sample of lenders who originate loans in the retail and consumer direct channels. The purchase applications from the WAS are predominantly for existing homes. The contrast in results since the start of 2023 is stark – the BAS, as of February 2024, shows a 16 percent annual increase in purchase applications, the 13th consecutive month of annual growth, while the WAS purchase index continues to show annual declines, with the February level of applications down almost 15 percent relative to a year ago.

MBA is forecasting that as interest rates decline to just north of 6 percent in the fourth quarter of 2024, new-home sales will continue to increase from an annualized rate of 712,000 in the first quarter of 2024 to 792,00 in the fourth quarter. Furthermore, existing-home sales will increase from 4.2 million to 4.5 million. This is welcome news and will help drive purchase originations to approximately $1.54 trillion in 2024, an increase of 16 percent over 2023.