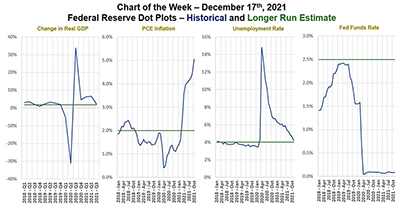

This week’s MBA Chart of the Week traces the Federal Open Market Committee forecasts and long-run estimates of four key metrics that contribute to Fed decision-making and communication – GDP, inflation, unemployment and the Fed funds rate.

Tag: MBA Chart of the Week

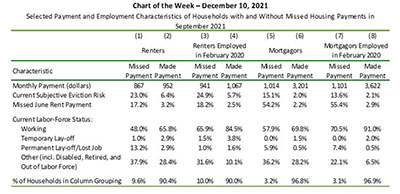

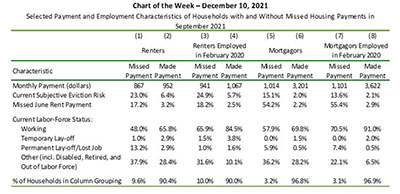

MBA Chart of the Week: Payment & Employment Characteristics

This week’s MBA Chart of the Week zeroes in on selected payment and employment characteristics of households who made and missed their rent and mortgage payments in September.

MBA Chart of the Week: Payment & Employment Characteristics

This week’s MBA Chart of the Week zeroes in on selected payment and employment characteristics of households who made and missed their rent and mortgage payments in September.

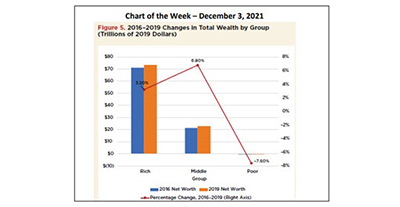

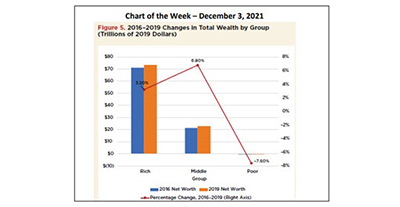

MBA Chart of the Week, Dec. 3, 2021: U.S. Household Wealth

This week’s MBA Chart of the Week shows that the net wealth of the rich, the top 10% of households, increased by 3.2% between 2016 and 2019, while the net worth of the poor, the bottom 30% of households, decreased by 7.6%.

MBA Chart of the Week, Dec. 3, 2021: U.S. Household Wealth

This week’s MBA Chart of the Week shows that the net wealth of the rich, the top 10% of households, increased by 3.2% between 2016 and 2019, while the net worth of the poor, the bottom 30% of households, decreased by 7.6%.

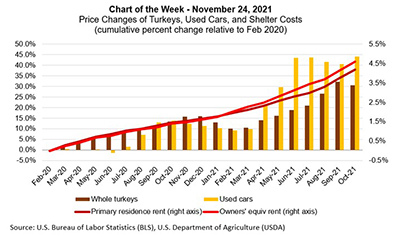

MBA Chart of the Week Nov. 24, 2021: Price Changes in Turkeys, Cars, Shelter

Inflation has been a dominant story of late, given the widespread disruption in supply chains and labor shortages resulting from the pandemic.

MBA Chart of the Week Nov. 24, 2021: Price Changes in Turkeys, Cars, Shelter

Inflation has been a dominant story of late, given the widespread disruption in supply chains and labor shortages resulting from the pandemic.

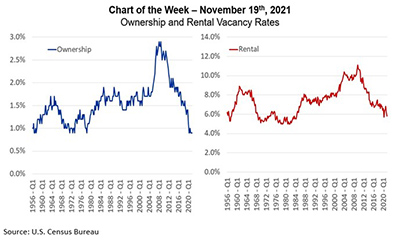

MBA Chart of the Week: Ownership & Rental Vacancy Rates

The U.S. housing stock is full.

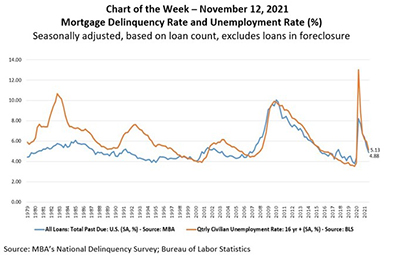

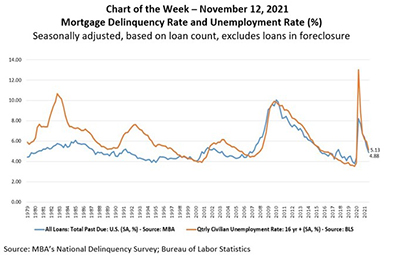

MBA Chart of the Week Nov. 12, 2021: Mortgage Delinquency Rate & Unemployment Rate

The delinquency rate for mortgage loans on one‐to‐four‐unit residential properties fell to a seasonally adjusted rate of 4.88 percent of all loans outstanding at the end of the third quarter, according to the Mortgage Bankers Association’s National Delinquency Survey, released last week.

MBA Chart of the Week Nov. 12, 2021: Mortgage Delinquency Rate & Unemployment Rate

The delinquency rate for mortgage loans on one‐to‐four‐unit residential properties fell to a seasonally adjusted rate of 4.88 percent of all loans outstanding at the end of the third quarter, according to the Mortgage Bankers Association’s National Delinquency Survey, released last week.