MBA Chart of the Week: FHFA Purchase-Only Price Index

On Tuesday, the Federal Housing Finance Agency released its August 2021 House Price Index. The purchase-only index, that tracks changes in transaction prices for conforming, conventional single-family purchase mortgages, showed that nominal seasonally adjusted house prices had appreciated by 18.5% from August 2020 to August 2021. However, the latest report shows price gains moderating from the month prior and suggests that annual gains may have peaked for the time being.

At MBA’s Annual Convention and Expo, the Research and Economics team rolled out its October 2021 mortgage finance forecast. Given FHFA’s release this week, we examine where we forecast house price appreciation is headed over the next three years.

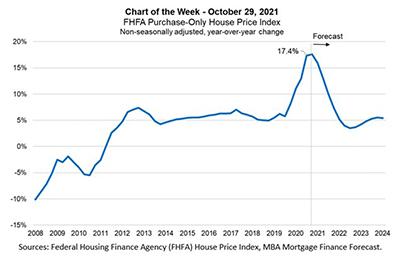

This week’s MBA Chart of the Week shows FHFA’s quarterly, non-seasonally adjusted year-over-year HPA starting from the fourth quarter of 2008 through the second quarter of 2021, together with MBA’s quarterly forecast through the end of 2024.

In the six years prior to the pandemic, annual HPA remained positive and averaged over 5.5%. In the third quarter of 2020, it jumped to 8.2%, and increased to 17.4% in the second quarter of 2021. While the months’ supply of new homes for sale climbed to over six months in the third quarter of 2021, the months’ supply for existing homes has remained (low) in the 2- to 3-month range since the second half of 2020. Meanwhile, existing-home sales were strong—over 6.6 million (annualized)—in the fourth quarter of 2020 and have remained over 6 million in 2021.

We forecast that this market imbalance will diminish as the supply of homes for sale increases in 2022 and 2023 and will contribute, among other things, to HPA coming back down. This forecast, in part, depends on new residential construction ramping up to meet the strong demand coming from new household formation and the replenishment of the rapidly aging housing stock. While the home building industry currently faces obstacles such as high materials costs, unpredictable delivery times for inputs, and labor shortages, we expect these to gradually fade, allowing for more inventory to enter the market.

As for-sale inventory increases, we forecast that HPA will peak from the second quarter’s 17.6% rate and slow to growth rates more in line with nominal wage growth: 5.2%, 4.2%, and 5.4% in the fourth quarter of 2022, 2023 and 2024, respectively

- Edward Seiler (eseiler@mba.org), Joel Kan (jkan@mba.org)