MBA Chart of the Week Nov. 5 2021: Single-Family Starts, Residential Construction Workers

The Employment Situation Report for October brought strong results for the overall job market: 531,000 jobs were added over the month across most sectors of the economy and the unemployment rate decreased further to 4.6%.

Notably for the housing market, there was also a boost to construction employment. Out of the 44,000 construction jobs added in October, about one-quarter of those were for residential construction and residential specialty trade contractors. This is of particular importance because housing demand, home sales and residential construction have rebounded following last year’s recession, but there continues to be a severe shortage of housing inventory. Even while production has picked up, home builders are facing labor shortages, rising costs for building materials and low availability of these materials, limited lot availability, and more.

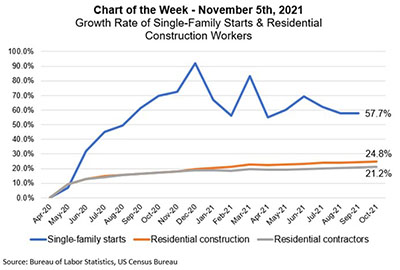

This week’s MBA Chart of the Week examines the growth rates of single-family construction and residential construction workers since the trough in home building activity in April 2020. The chart highlights the shortfall in labor growth despite elevated levels of single-family starts. At the beginning of the pandemic, single-family housing starts bottomed at 685,000 units in April 2020 and subsequently rebounded as the economy reopened and housing demand returned, peaking at 1.3 million starts in December of last year, a 92% peak to trough increase. However, the comparable growth rate for labor between April and December was only around 19% for both residential building and contractor employment.

The growth rates in construction jobs continue to lag that of single-family starts and as of the most recent months’ data, single-family starts were 57% higher than in April 2020, while residential construction and contractor payrolls were 25% and 22% higher, respectively. New homes are needed to ease inventory shortages across the country, especially for entry-level and starter homes, which is contributing to stiff buying competition and rapidly rising home prices. Our forecast is for an upward trend in purchase originations for 2022 and 2023, which will be driven by a strong pace of housing starts, more for-sale inventory, and a faster pace of home sales.

- Mike Fratantoni (mfratantoni@mba.org), Joel Kan (jkan@mba.org)