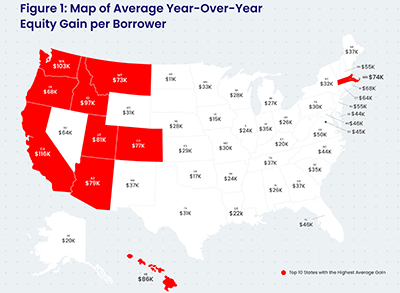

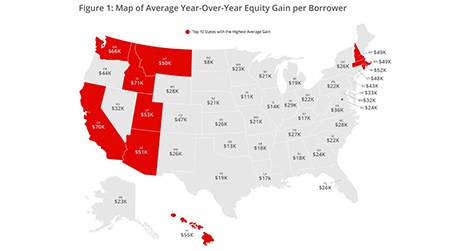

CoreLogic, Irvine, Calif., said homeowners with mortgages saw their equity increase by 29.3% year over year, representing a collective equity gain of more than $2.9 trillion and an average gain of $51,500 per borrower over the past year.

Tag: Frank Nothaft

CoreLogic: June Foreclosure Inventory Rate Lowest in Two Decades

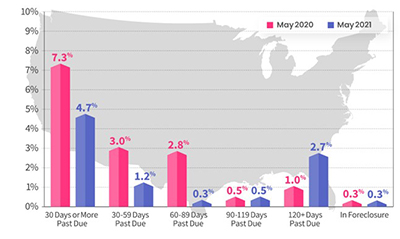

CoreLogic, Irvine, Calif., said 4.4% of all mortgages in the U.S. were in some stage of delinquency in June, a 2.7-percentage point decrease in delinquency from a year ago but above the February 2020 pre-pandemic rate of 3.6%.

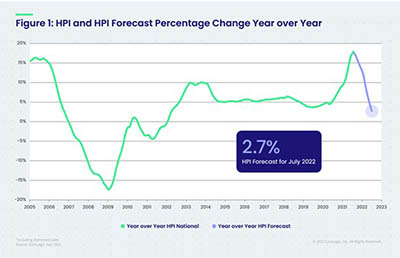

CoreLogic Home Price Index Hits Record High

The CoreLogic Home Price Index reported annual home price growth in July jumped to the highest rate in its 45-year history.

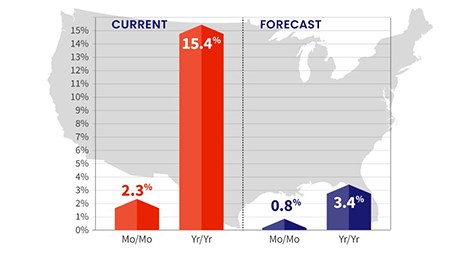

Torrid Demand, Scarce Inventory Fuels Double-Digit Home Price Growth

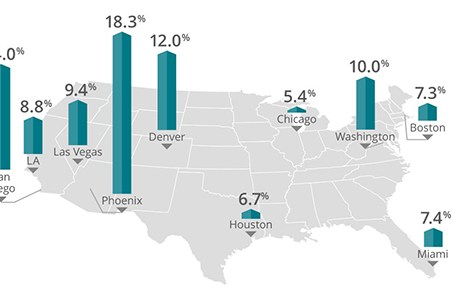

Our story so far: high demand for housing, coupled with near record-low inventories, results in double-digit annual home price growth. CoreLogic, Irvine, Calif., is the latest to confirm the trend.

1Q Homeowner Equity Gains $1.9 Trillion

Corelogic, Irvine, Calif., said “underwater” (negative equity) homes decreased by 24% year over year in the first quarter, while the average homeowner gained $33,400 in equity year over year.

CoreLogic: Strong Improvement in U.S. Mortgage Delinquency Rates

CoreLogic, Irvine, Calif., said just 4.9 percent of all mortgages in the U.S. were in some stage of delinquency, the lowest rate in more than a year.

CoreLogic: Home Prices Rise at Fastest Pace Since 2006

CoreLogic, Irvine, Calif., said sparse inventory and high demand placed upward pressure on home prices, leading to a third straight month of double-digit percentage growth.

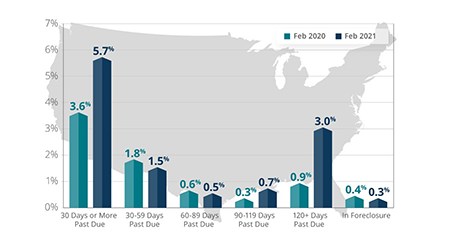

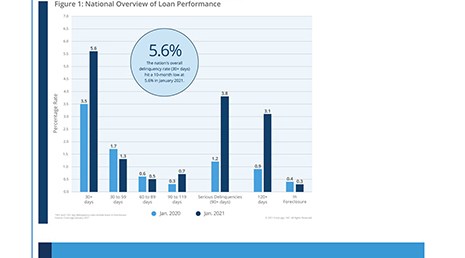

CoreLogic: Mortgage Delinquency Rates Level Off in February

Despite a small uptick in overall delinquencies, serious delinquencies continued to decrease, CoreLogic, Irvine, Calif., reported this morning.

CoreLogic: Millennial Demand Pushes Home Prices to Highest Annual Growth in 15 Years

CoreLogic, Irvine, Calif., reported its monthly Home Price index recorded an 11.3% annual gain in March, the highest rate since March 2006.

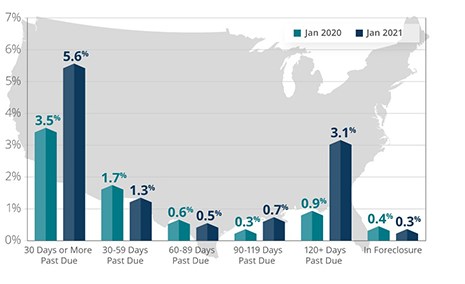

CoreLogic: Annual Mortgage Delinquency Rate Drops for 5th Straight Month to 10-Month Low

CoreLogic, Irvine, Calif., said while mortgage delinquencies rose month over month in January, overall delinquency rates fell for the fifth straight month to the lowest level since last March.