CoreLogic: Mortgage Delinquency Rates Level Off in February

Despite a small uptick in overall delinquencies, serious delinquencies continued to decrease, CoreLogic, Irvine, Calif., reported this morning.

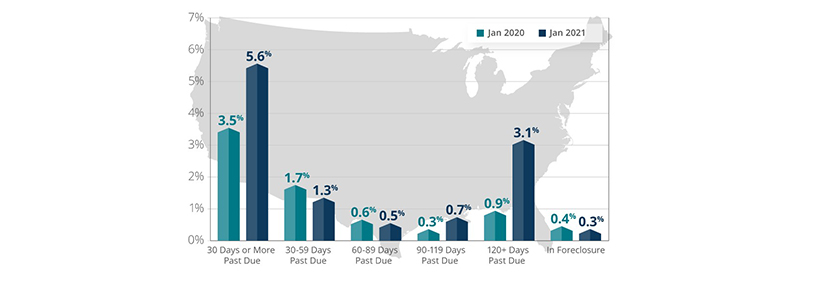

The company’s monthly Loan Performance Insights Report said 5.7% of all mortgages in the U.S. were in some stage of delinquency (30 days or more past due, including those in foreclosure) in February, representing a 2.1-percentage point increase in the overall delinquency rates from a year ago. The slight (0.1 percentage point) increase over January marks the first uptick in month-to-month national delinquency since August 2020.

Other report findings:

· Early-Stage Delinquencies (30 – 59 days past due): 1.5%, down from 1.8% a year ago.

· Adverse Delinquency (60 – 89 days past due): 0.5%, down from 0.6% a year ago.

· Serious Delinquency (90 days or more past due, including loans in foreclosure): 3.7%, up from 1.2% in February.

· Foreclosure Inventory Rate (the share of mortgages in some stage of the foreclosure process): 0.3%, down from 0.4% a year ago.

· Transition Rate (the share of mortgages that transitioned from current to 30 days past due): 0.9%, unchanged from a year ago.

CoreLogic Chief Economist Frank Nothaft said government support throughout the pandemic, and improving employment rates, have enabled more borrowers to remain current on their mortgages than would otherwise have occurred. With a more optimistic economic outlook, consumer sentiment has improved.

“Some families that had overspent during the year-end holiday season, and then faced financial stress in the new year, may slip behind on a mortgage payment by February,” Nothaft said. “During each of the last five years, the 30-day delinquency rate moved higher from January to February. With economic conditions improving, we expect delinquency rates to move lower in coming months.”

A recent CoreLogic consumer survey noted eight in 10 respondents indicated they were unlikely to fall behind on their mortgage payment based on their current financial situation.

“Overall delinquency ticked up slightly in February, but the serious delinquency and foreclosure rates continued a monthly decline,” said Frank Martell, president and CEO of CoreLogic. “Consumer confidence continues to rise as the economy roars back to life. These factors bode well for housing fundamentals in 2021 and as far as the eye can see.”

The report said all U.S. states and nearly all metro areas logged increases in annual overall delinquency rates in February. Hawaii and Nevada (both up 4 percentage points) again logged the largest annual increase in overall delinquency rates in February.

Among metros, Odessa, Texas, still recovering from job losses in the oil industry, had the largest annual overall delinquency increase with 9.9 percentage points. Other metro areas with significant overall delinquency increases included Midland, Texas (up 7.7 percentage points); Kahului, Hawaii (up 6.5 percentage points) and Lake Charles, La. (up 6.2 percentage points).

On Friday, the Mortgage Bankers Association reported the delinquency rate for mortgage loans on one-to-four-unit residential properties fell to 6.38 percent of all loans outstanding, seasonally adjusted, at the end of the first quarter.

The MBA 1st Quarter National Delinquency Survey said the delinquency rate fell by 35 basis points from the fourth quarter but rose by 202 basis points from a year ago.