CoreLogic: June Foreclosure Inventory Rate Lowest in Two Decades

CoreLogic, Irvine, Calif., said 4.4% of all mortgages in the U.S. were in some stage of delinquency in June, a 2.7-percentage point decrease in delinquency from a year ago but above the February 2020 pre-pandemic rate of 3.6%.

The company’s monthly Loan Performance Insights Report also noted the foreclosure inventory rate fell to just 0.2%, down from 0.3% a year ago, to the lowest rate since CoreLogic began recording data in 1999.

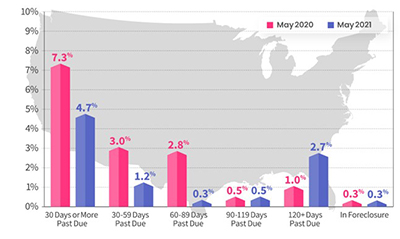

The report said early state delinquencies (30 to 59 days past due) fell to 1.1% in June, down from 1.8% a year ago. Adverse delinquencies (60 to 89 days past due) fell to 0.3%, down from 1.8% a year ago; and serious delinquencies (90 days or more past due, including loans in foreclosure) fell to 3%, down from 3.4% a year ago. While still high, this represented the 10th consecutive month of declines and the lowest serious delinquency rate since May 2020.

The transition rate (the share of mortgages that transitioned from current to 30 days past due) fell to 0.6%, down from 1% a year ago.

“The downward trend in delinquencies, especially serious cases, is very encouraging — and a testimony to the impact of the significant economic rebound over the past six months, as well as government stimuli, record-low mortgage rates and loan modification options,” said Frank Martell, president and CEO of CoreLogic.

“While job and income growth has helped to push delinquency rates down, there are many families that remain in financial distress,” said Frank Nothaft, chief economist with CoreLogic. “More than one million borrowers had missed six or more payments as of June, triple the number of borrowers pre-pandemic. CoreLogic analysis found that as of June 2021, borrowers in forbearance and behind on mortgage payments had missed an average of 10 monthly payments.”

The report noted in June, the federal foreclosure moratorium was extended once more through July 31 to provide homeowners additional time to get financially back on track. The moratorium has helped move the foreclosure rate to a new generational low. However, a CoreLogic survey of mortgage holders found that nearly half (43%) of respondents said they do not understand government mortgage relief programs, which could be contributing to higher overall delinquency rates.

“Providing resources to homeowners experiencing distress to help educate them on available government and private-sector support will aide in shrinking delinquency and foreclosure rates even more over the remainder of this year,” Martell said.

Other report findings:

–All U.S. states logged a decrease in annual overall delinquency rates, with New Jersey (down 4.8 percentage points), New York (down 4.4 percentage points) and Florida (down 4.1 percentage points) leading with the largest declines.

–All U.S. metros also posted an annual decrease in overall delinquency rates in June, with Miami (down 6.6 percentage points), Laredo, Texas (down 5.7 percentage points) and Kingston, N.Y. (down 5.6 percentage points) posting the largest decreases.

–Nevertheless, elevated overall delinquency rates remain in some metros, including Odessa (11.1%) and Laredo (10.7%), Texas; Vineland, N.J.,(10.6%); and Pine Bluff, Ark. (10.4%).